| Required Apps |

•

account_accountant

• base |

| Technical Name | post_dated_cheque_management_knk |

| License | OPL-1 |

| Also available in version | v 16.0 v 17.0 |

Post Dated Cheque Management-Enterprise Edition

Post Dated Cheque Management Allows you to manage post dated cheques for the customer as well as vendors. With the help of the Post Dated Cheque Module invoices/bills also get Paid. It will help to manage a Post Dated Cheque with accounting journal entries. We can also track the different states of cheques, like Return, Deposite, Bounce, and Done state.

Key Features of Post Dated Cheque Management Module

- You can paid Cheque only in Company set Currency.

- Easy to manage single Vendor/Customer payment.

- We can pay invoices/bills Manually or Autopaid.

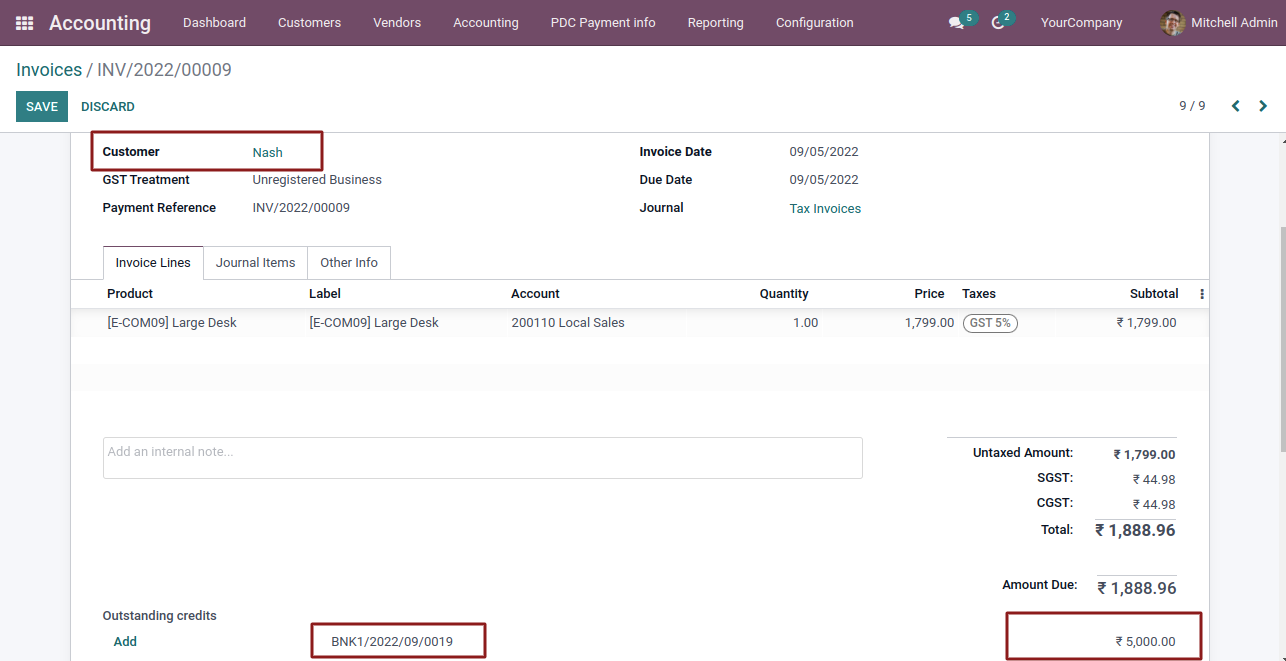

- The leftover balance after payment invoices/bills will be added/shown in the next invoices/bills.

- Easy to manage multiple invoices/bills payment.

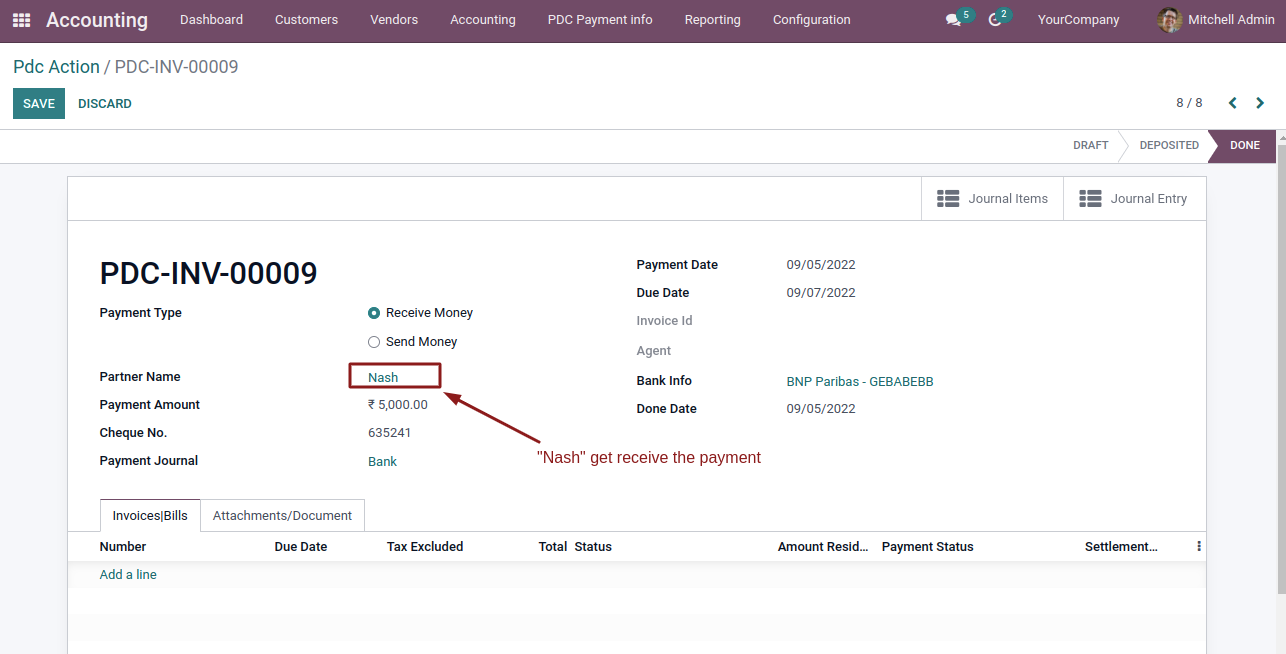

- We Can Also take advance payment For Customer/Vendor.

- We can pay any particular invoices/Bills as per the Cheque amount we have.

- We Can also attach the Cheque images.

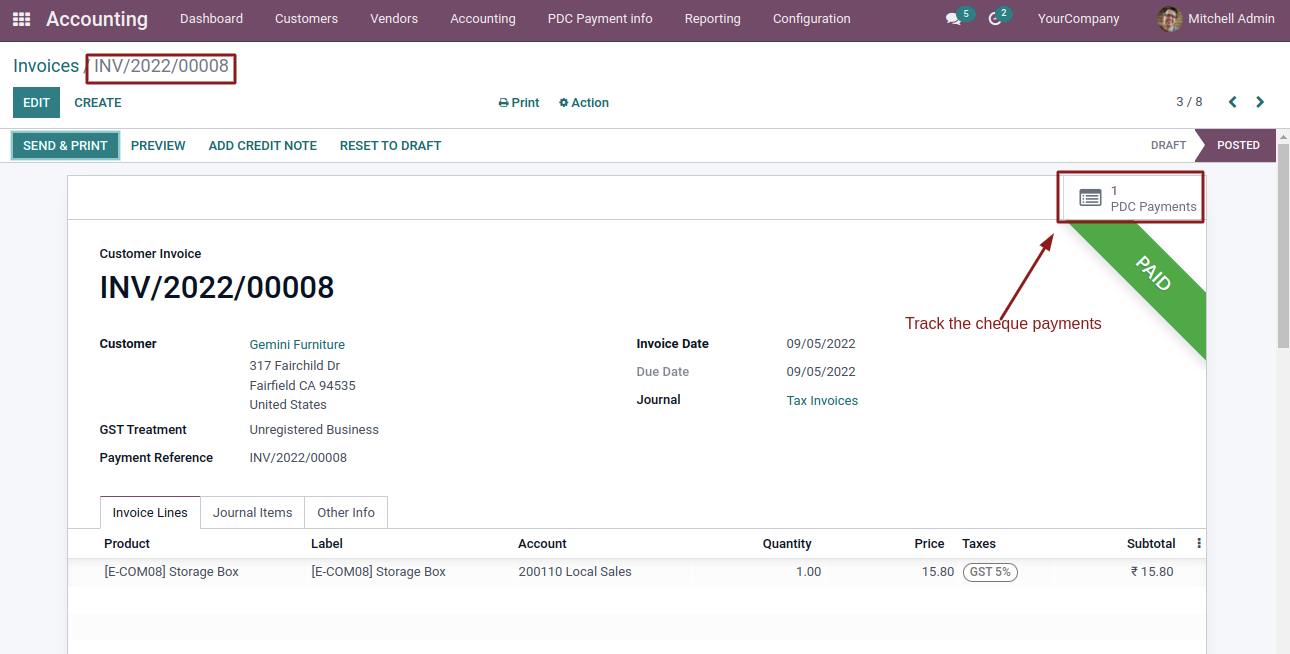

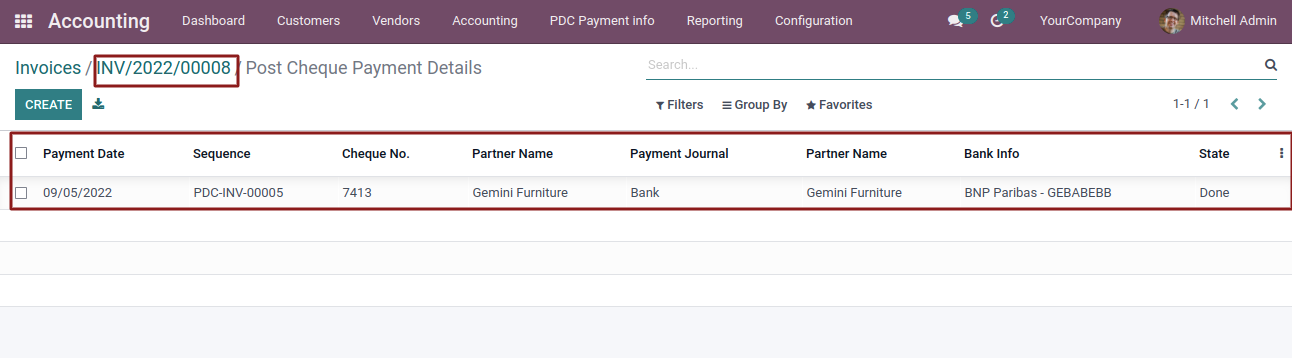

- Track the Cheques payment received againts the Invoices/Bills.

-

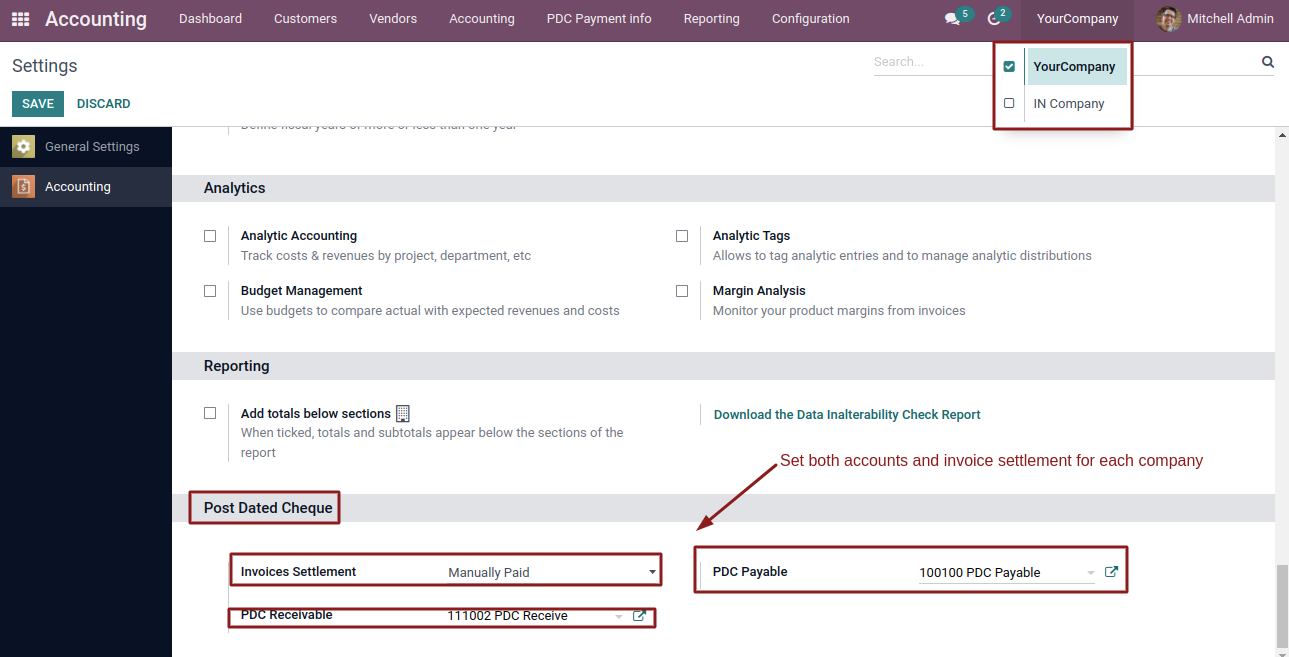

Set the Invoice Settlement

1. Manual

2.Autopaid -

Set two account for PDC.

1. Pdc Receivable

2.Pdc Payable

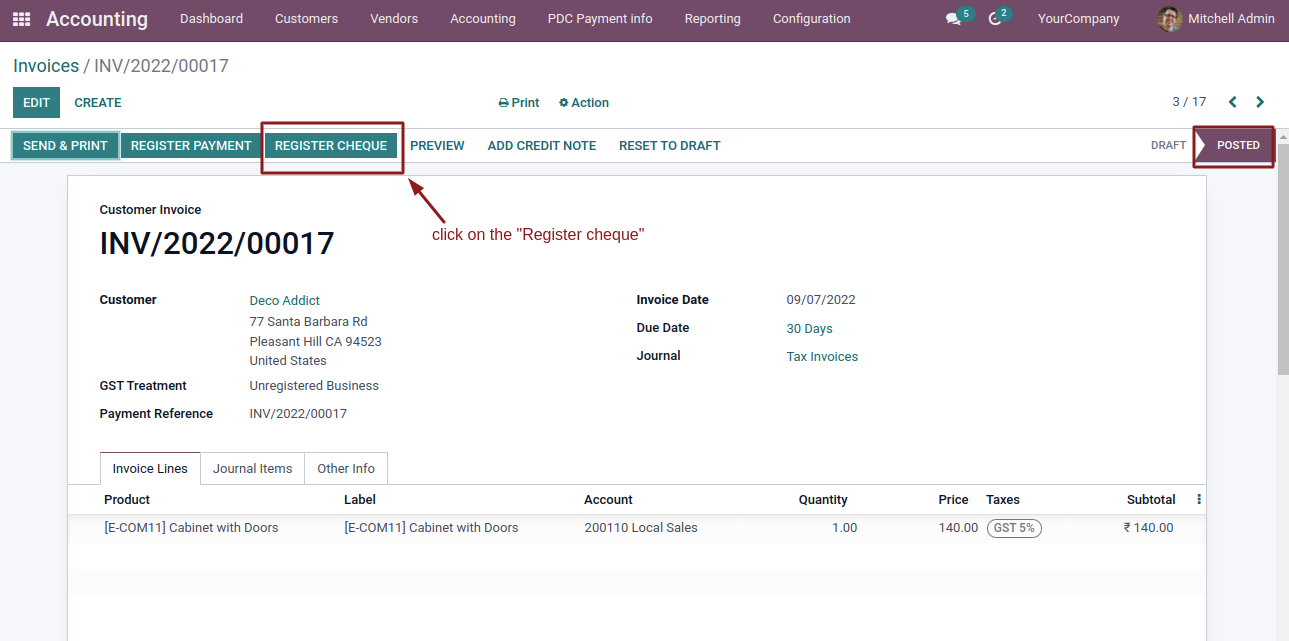

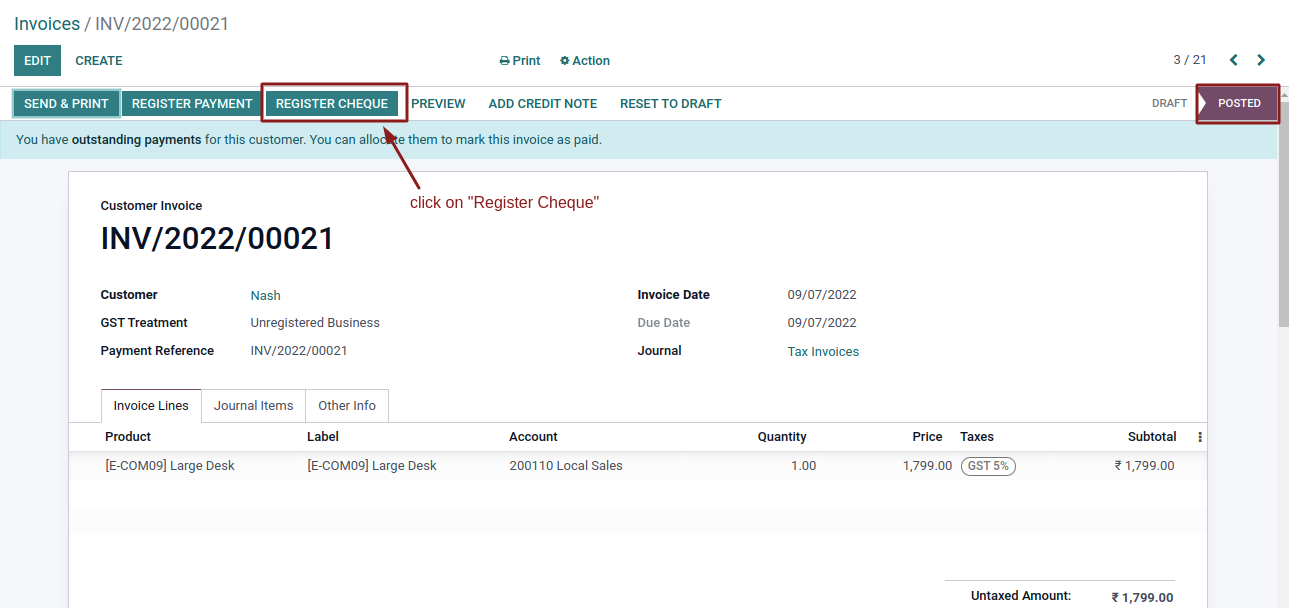

- Create Invoice and view Register Cheque button(In Posted state) in invoice form

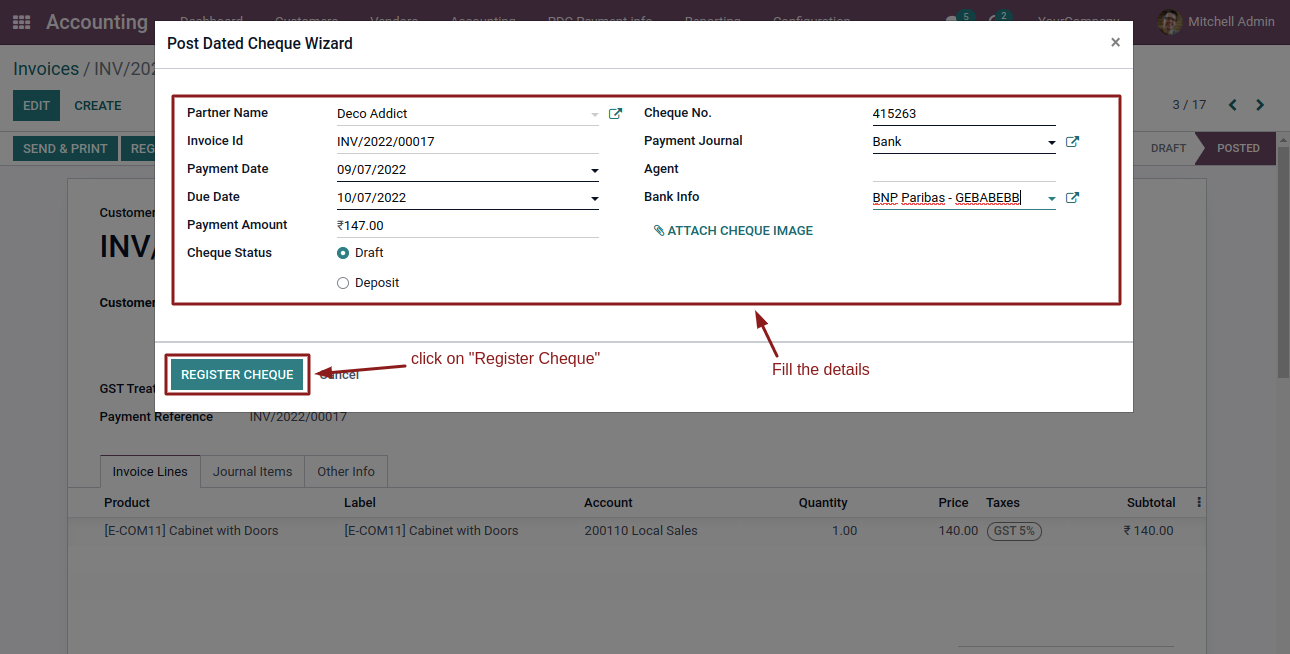

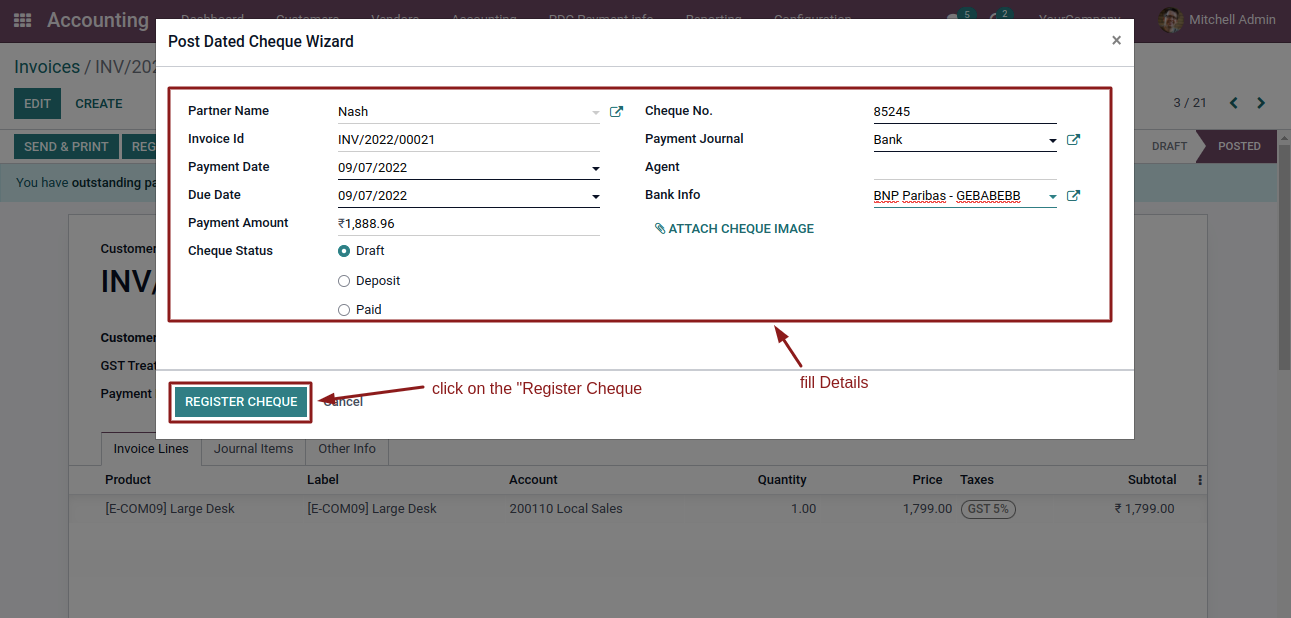

- Enter the cheque details

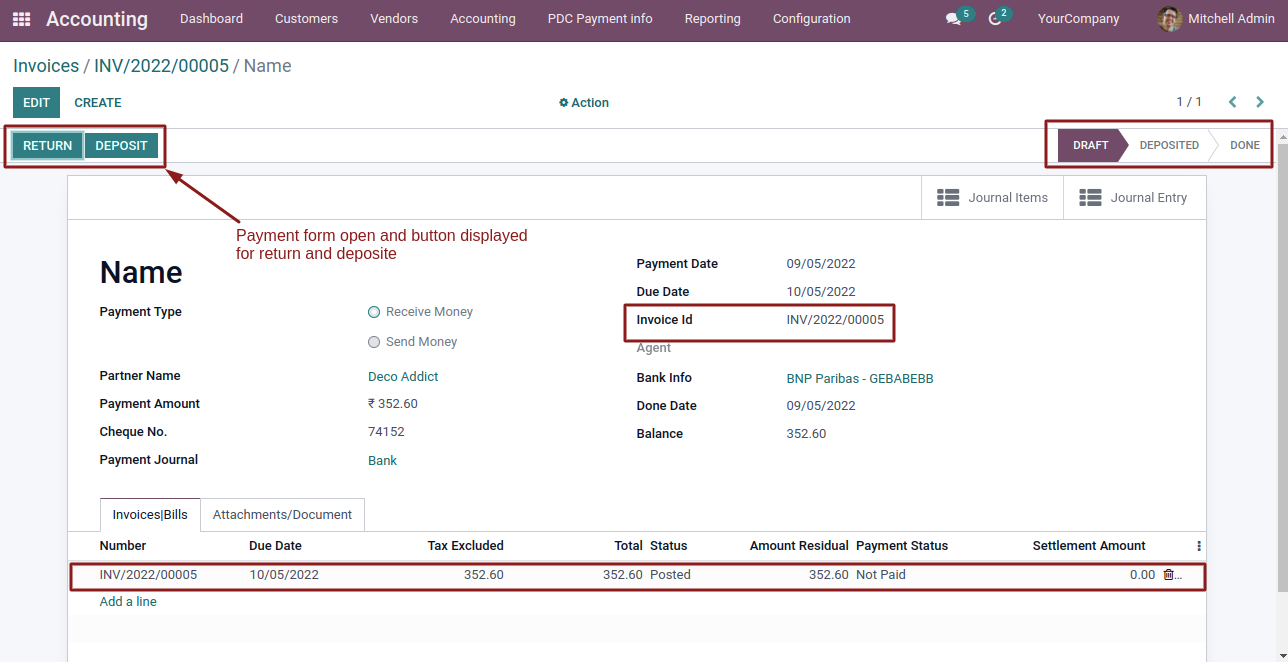

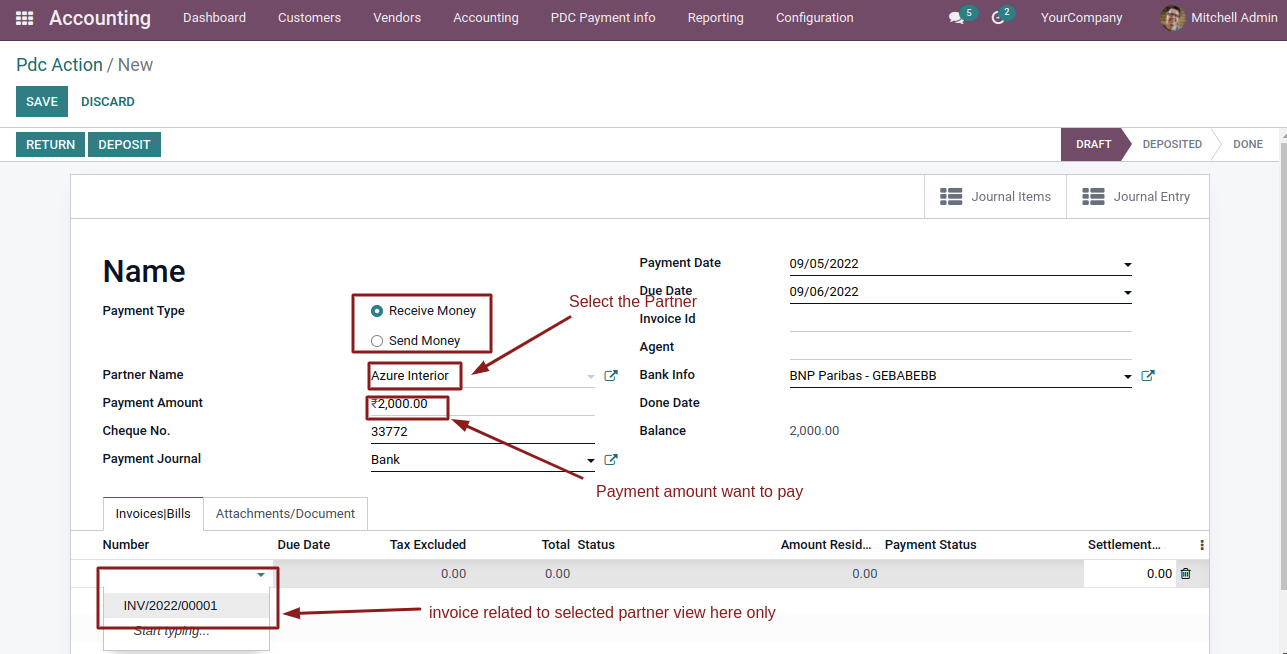

- On entering details and click on Register Cheque button,PDC payment form open

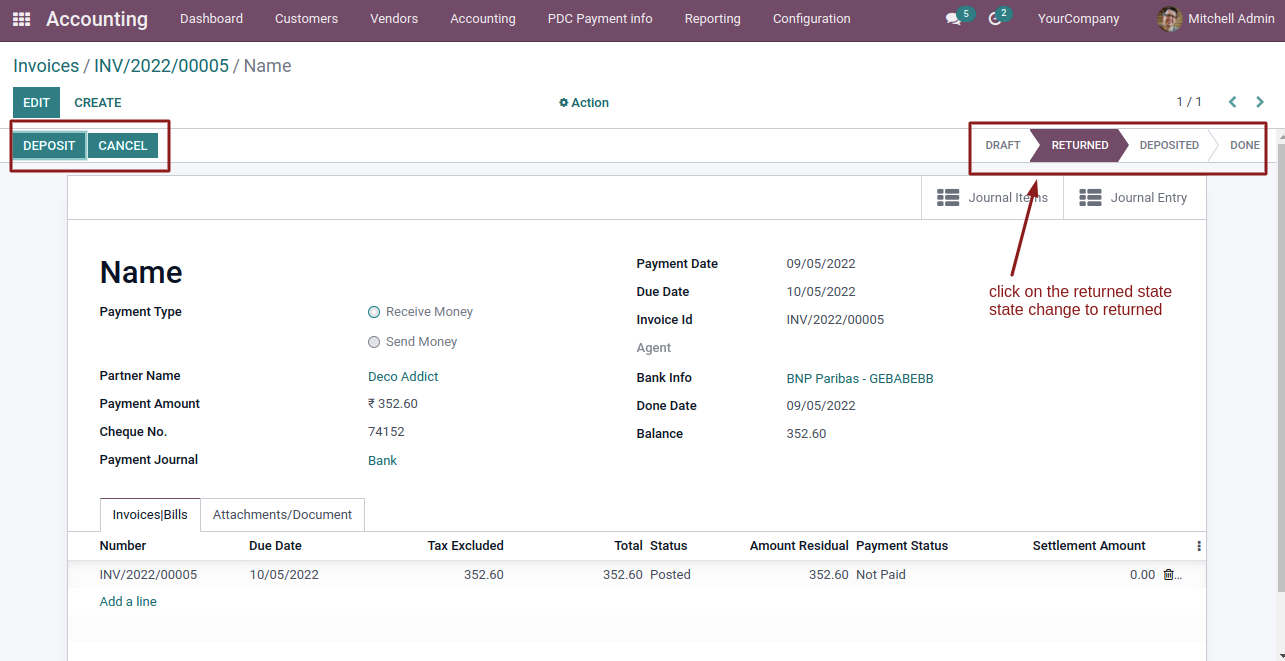

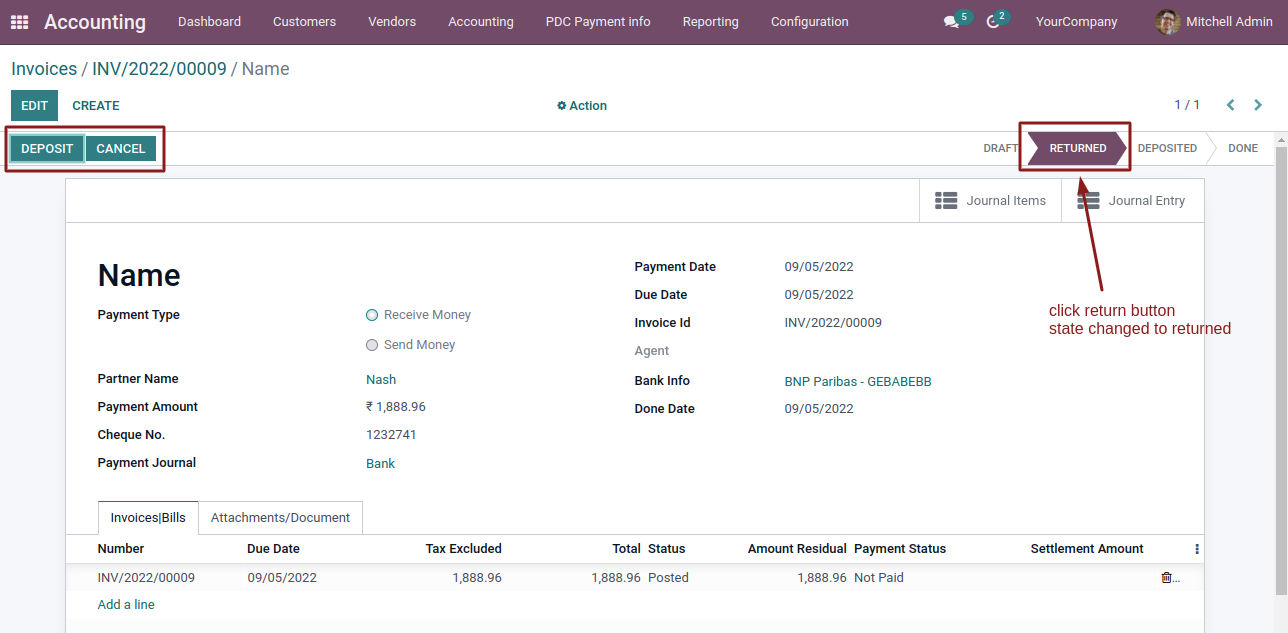

- On click Return button in PDC payment form,Cheque state Change to 'Returned' state

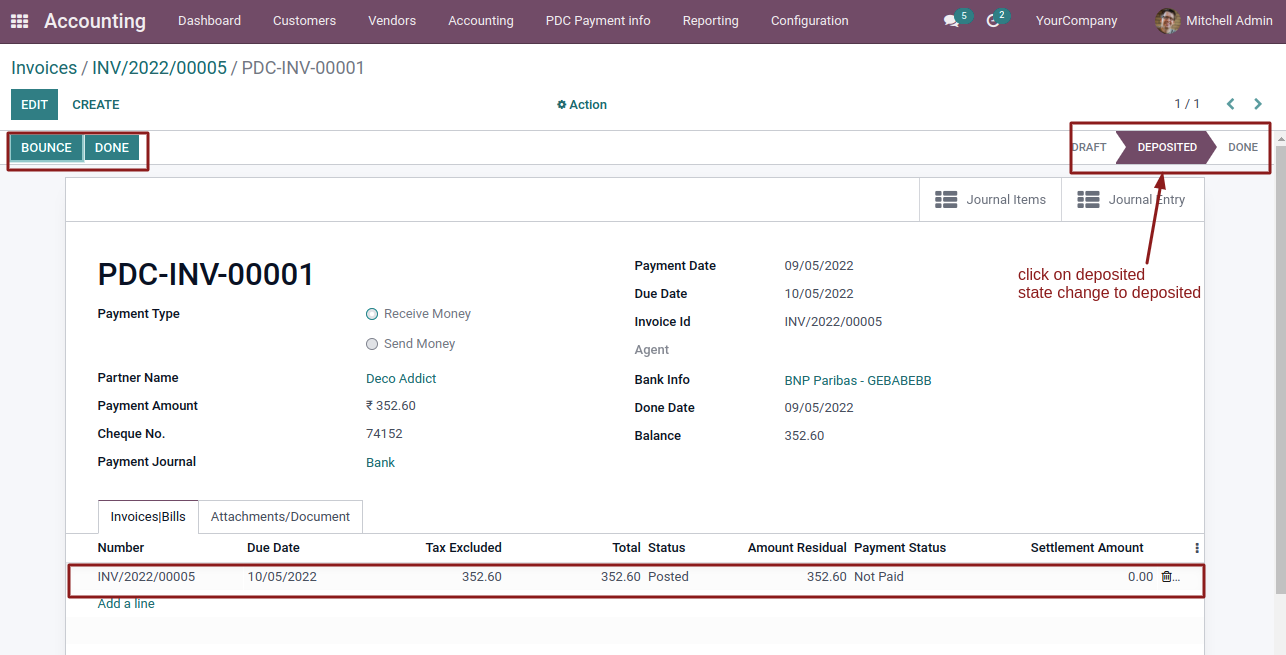

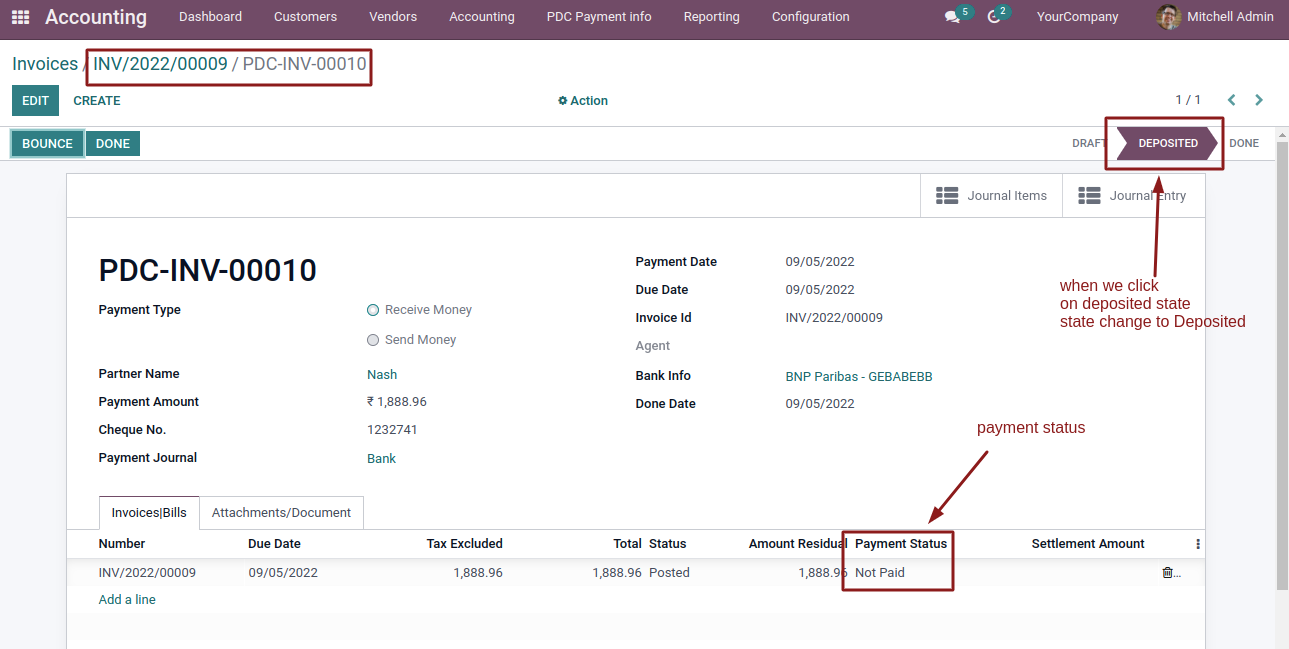

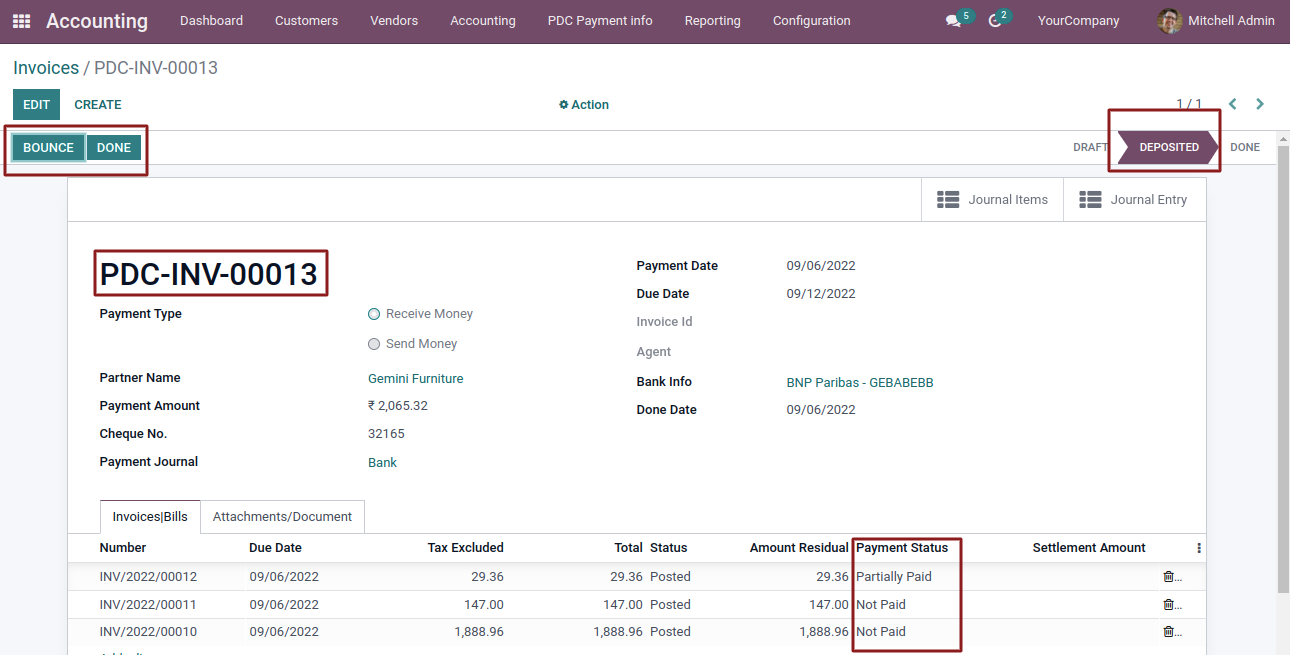

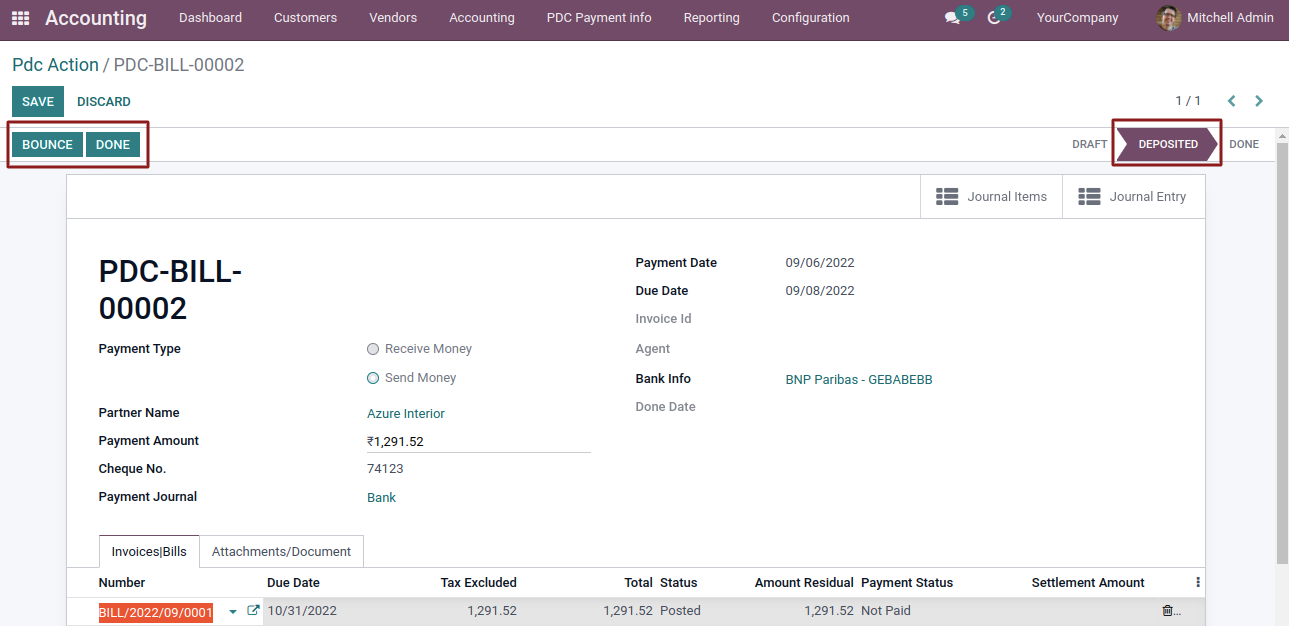

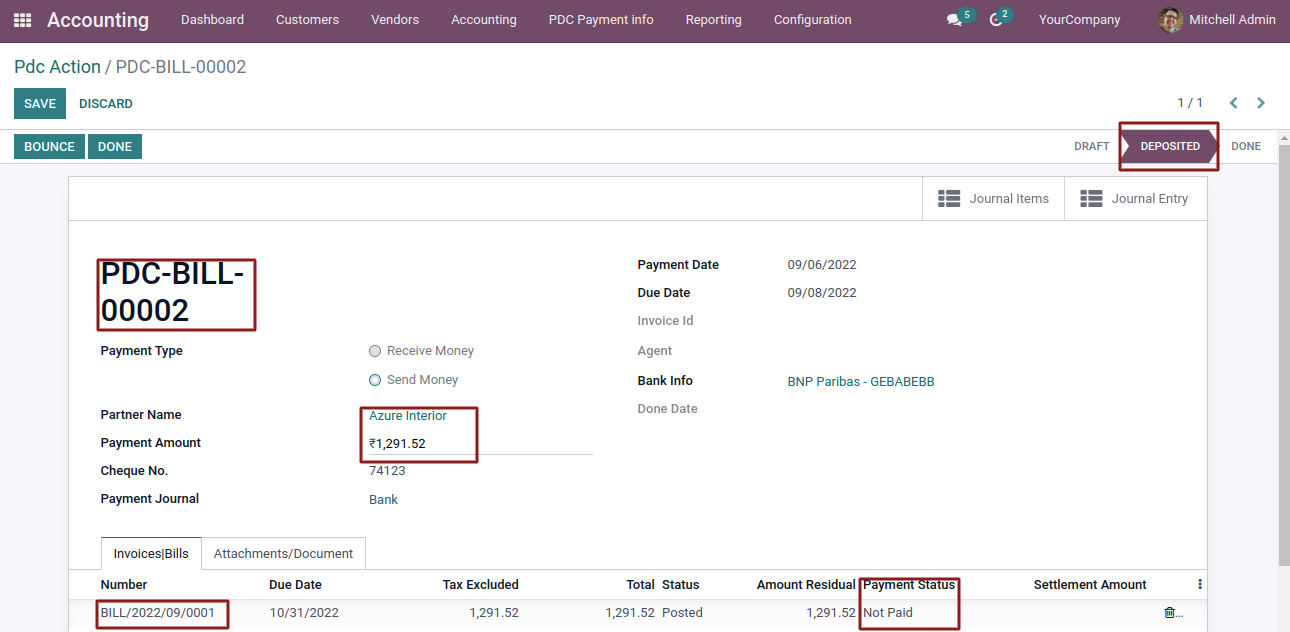

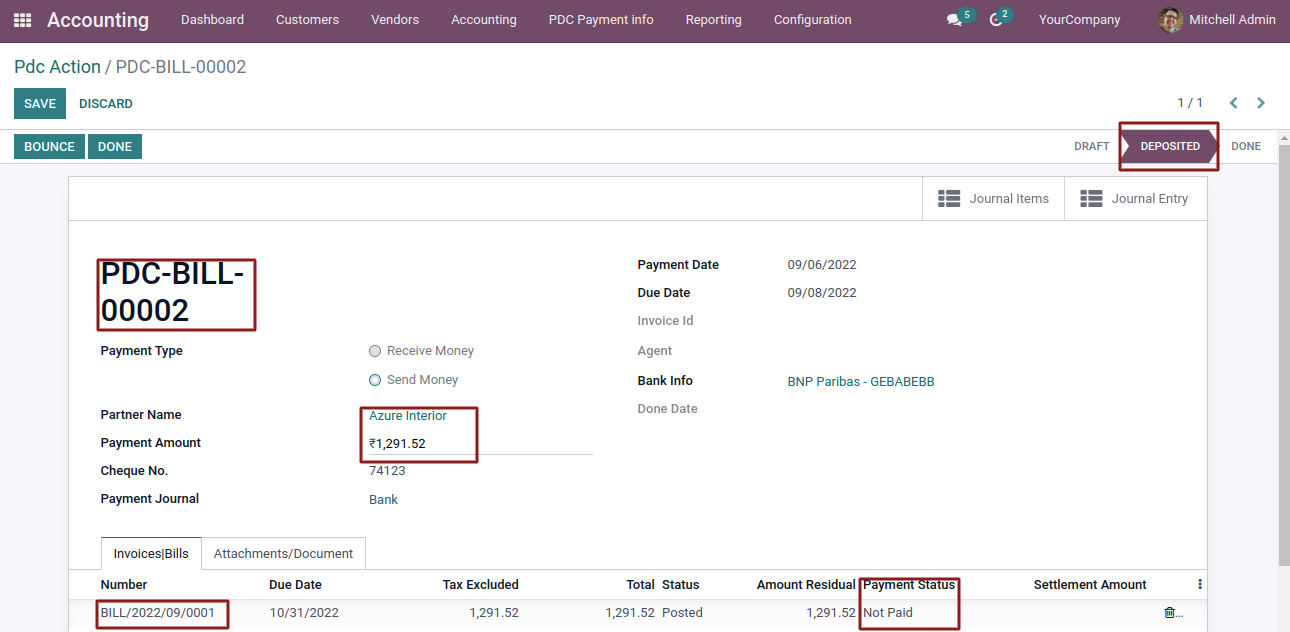

- On Click Deposite button in PDC payment form State change to Deposited

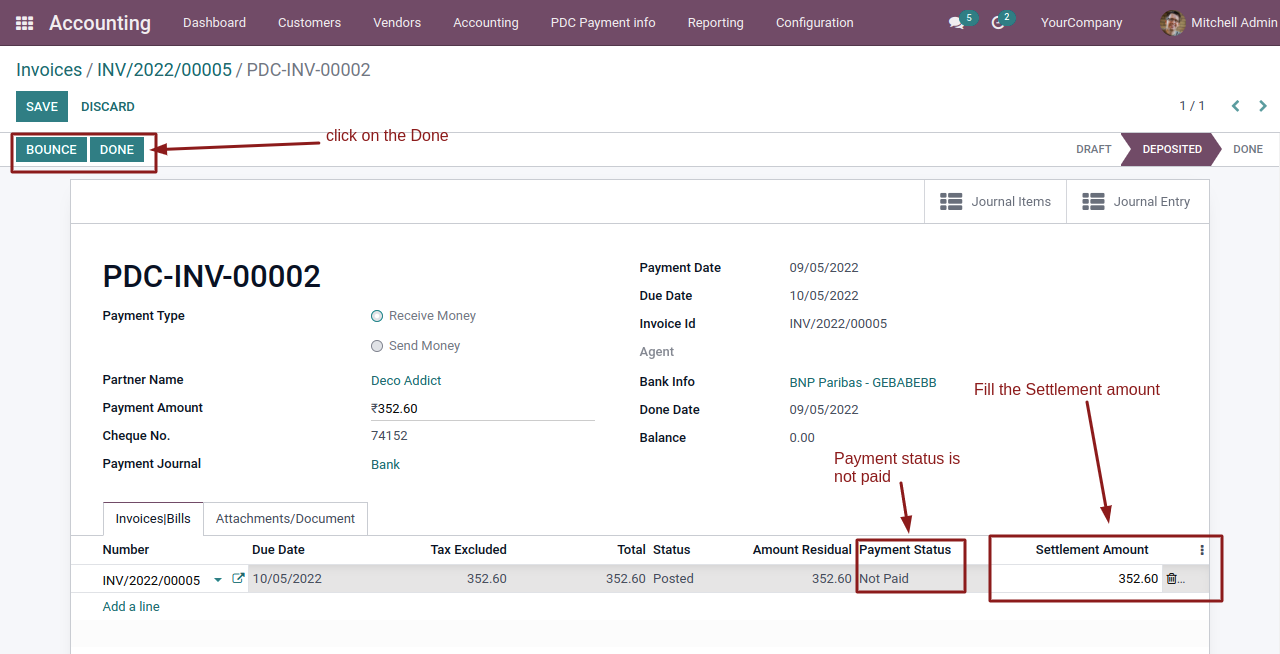

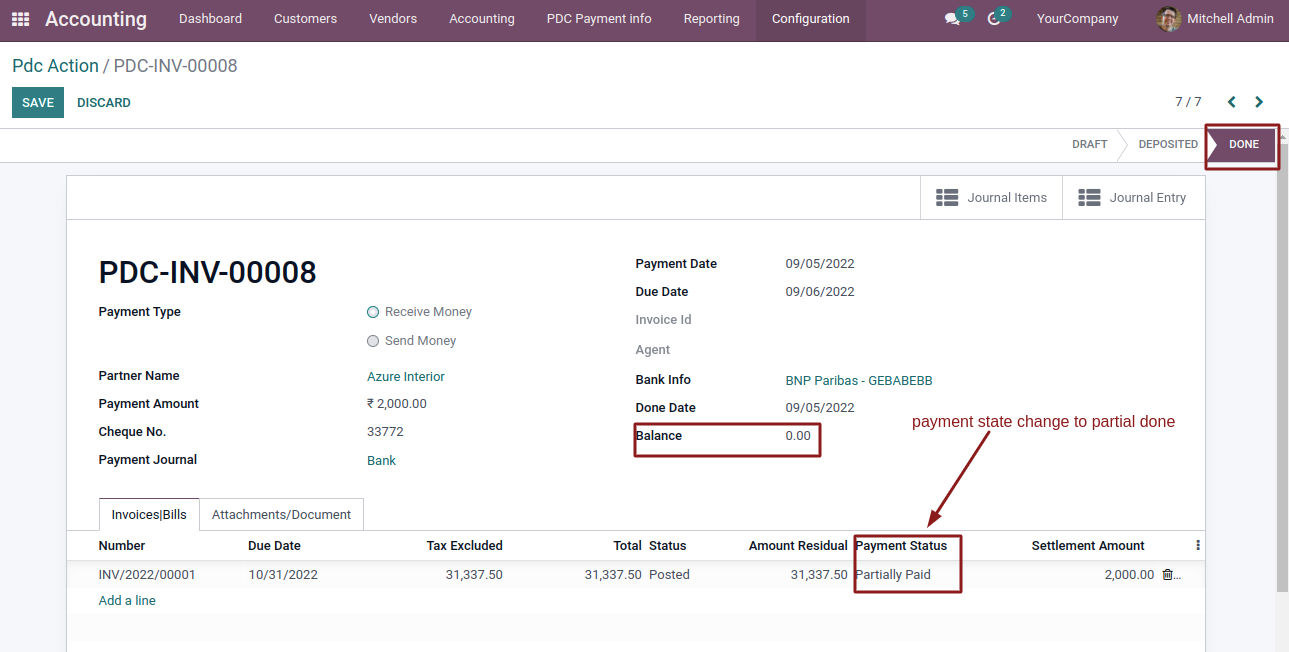

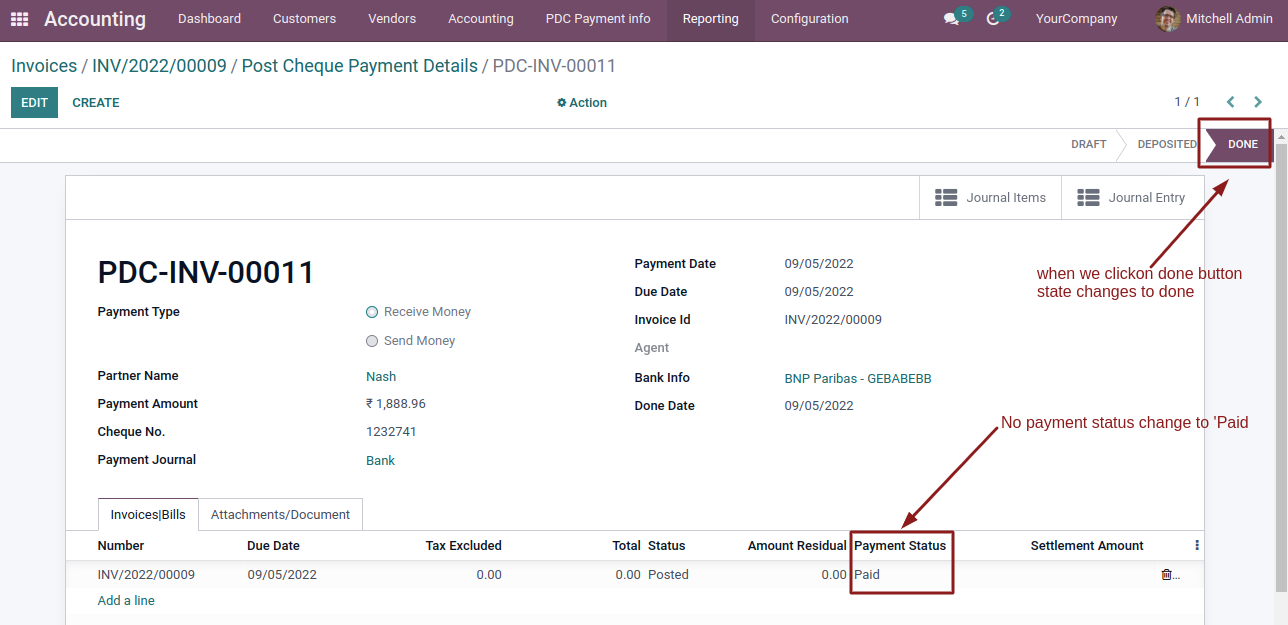

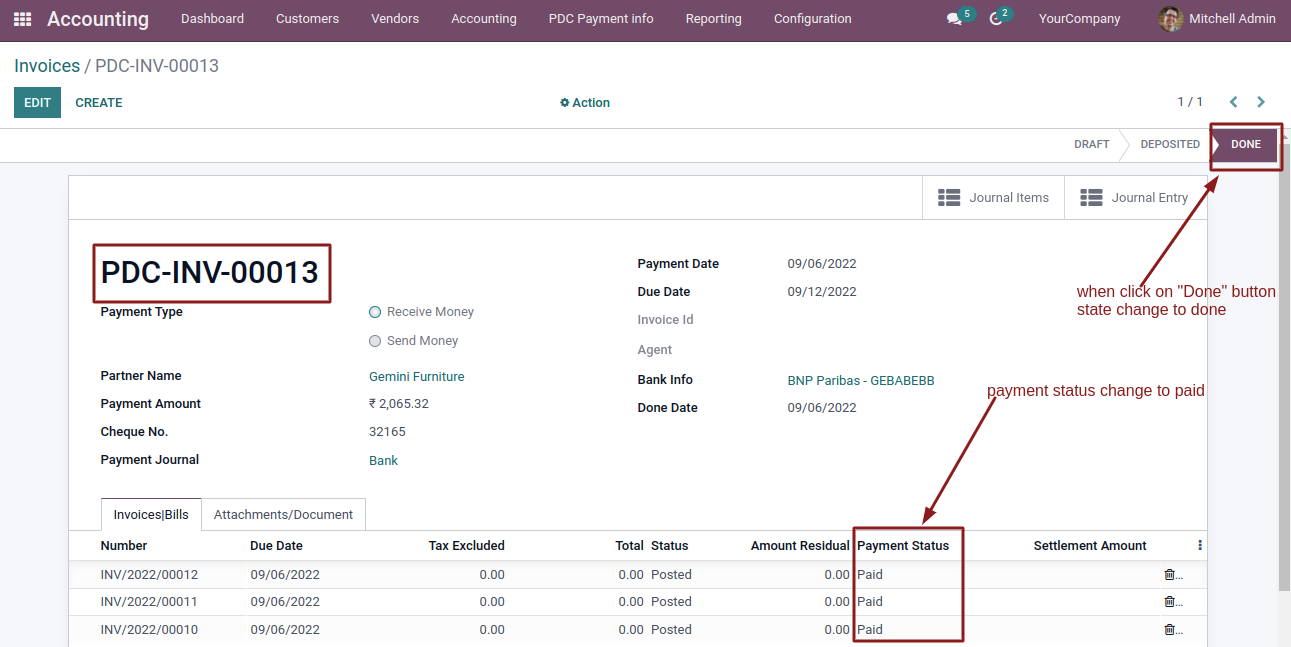

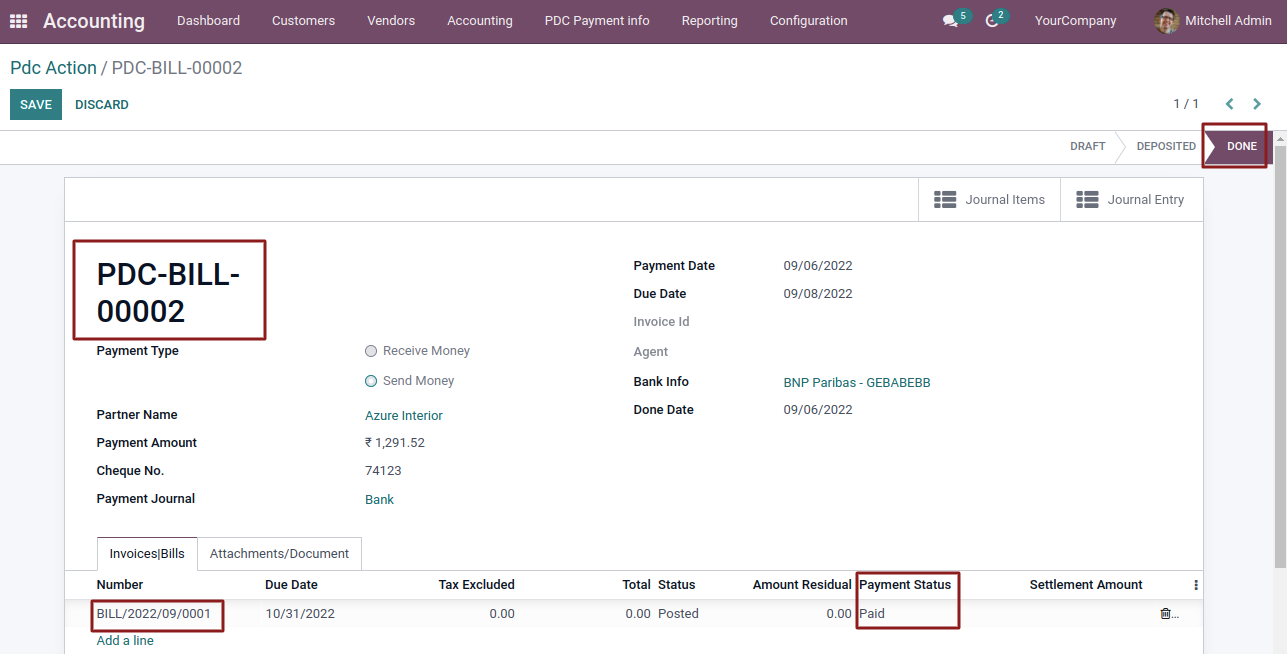

- Enter the amount settlement and Click Done button

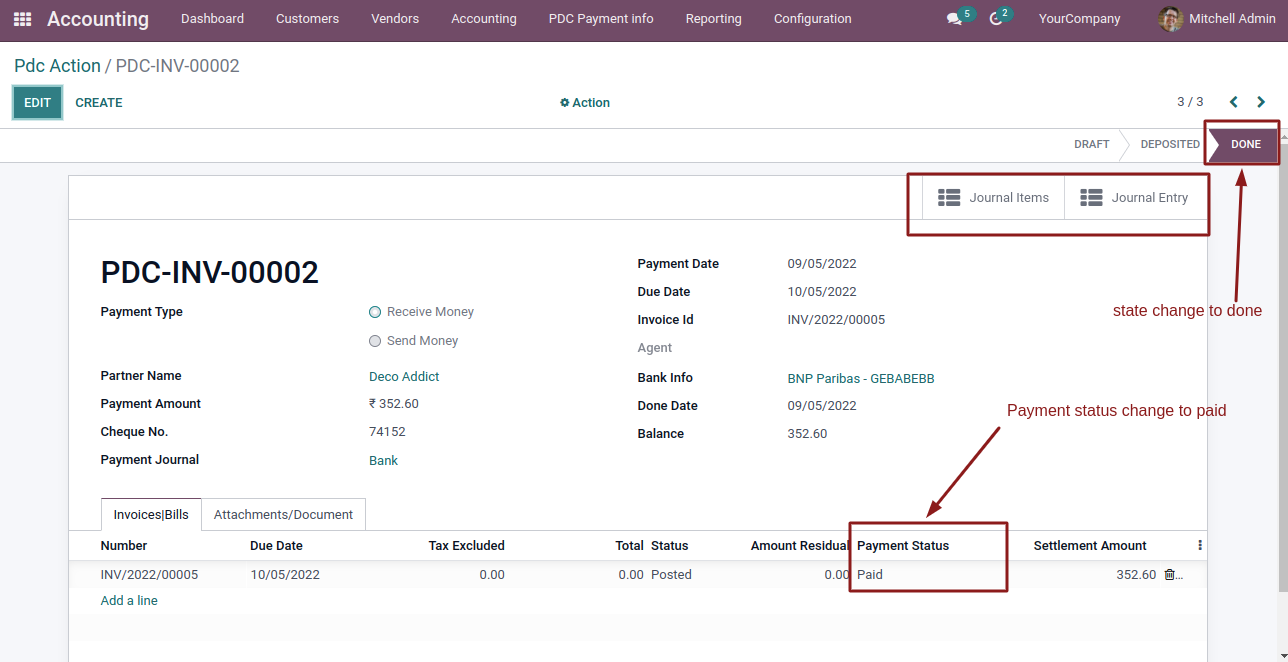

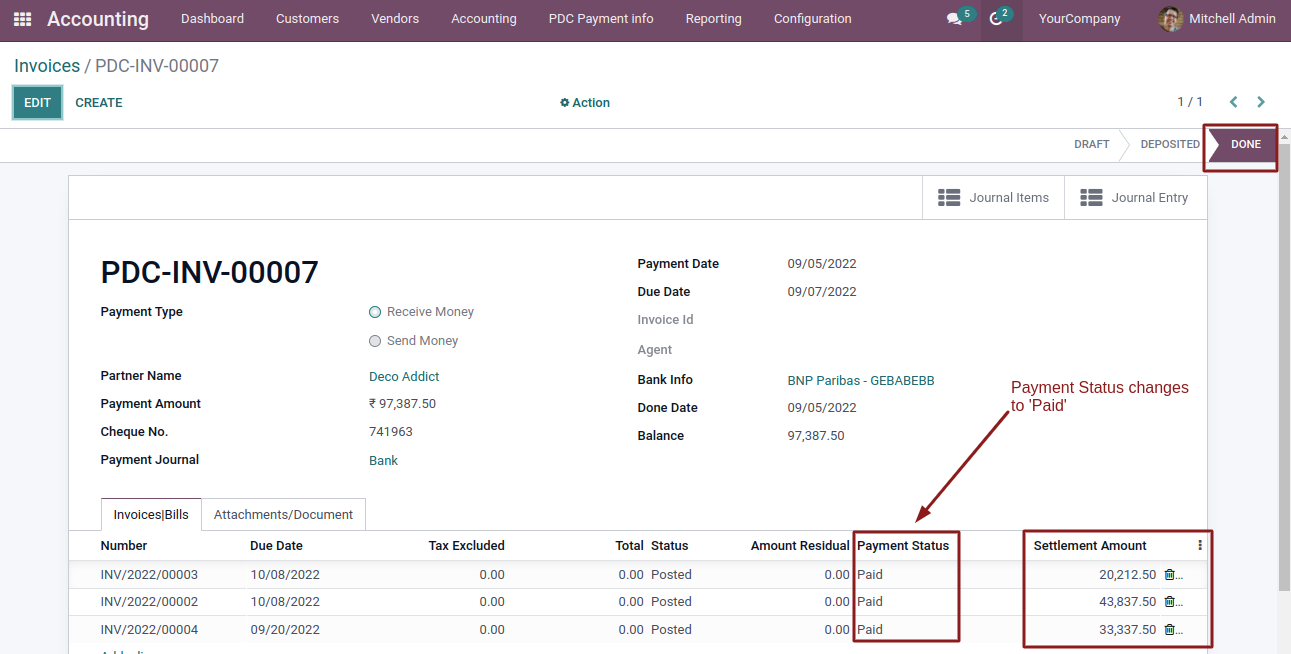

- Cheque State changes to done and payment status to 'Paid'

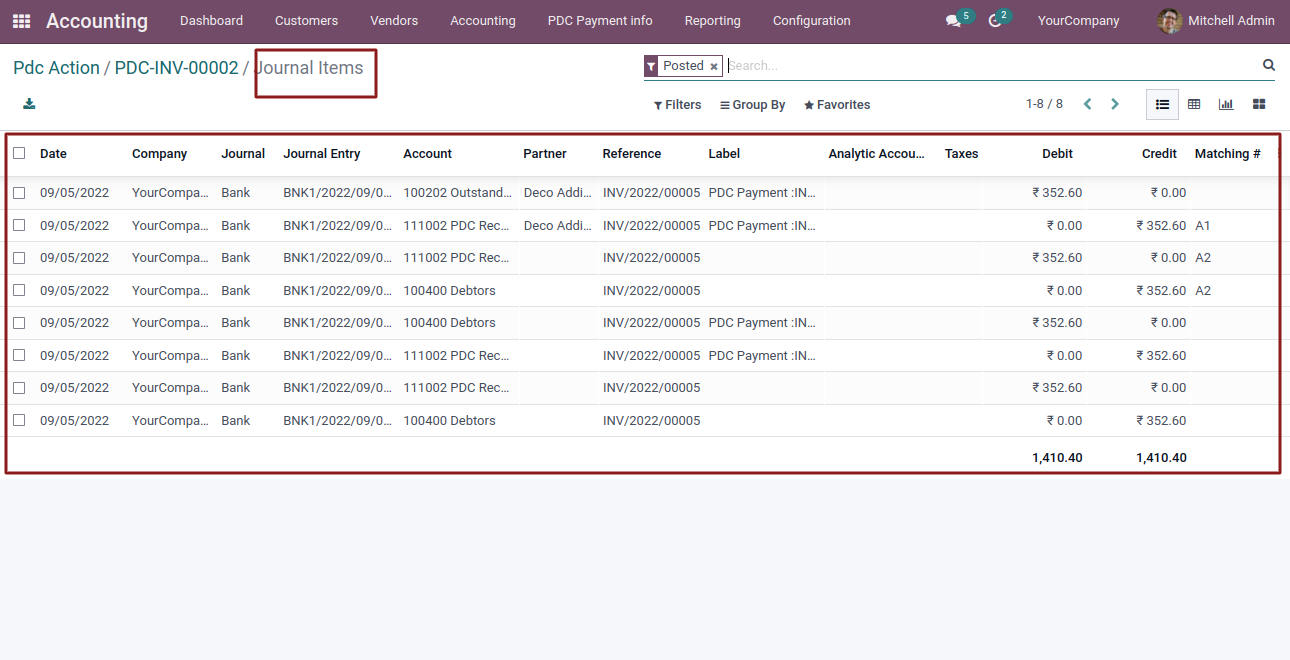

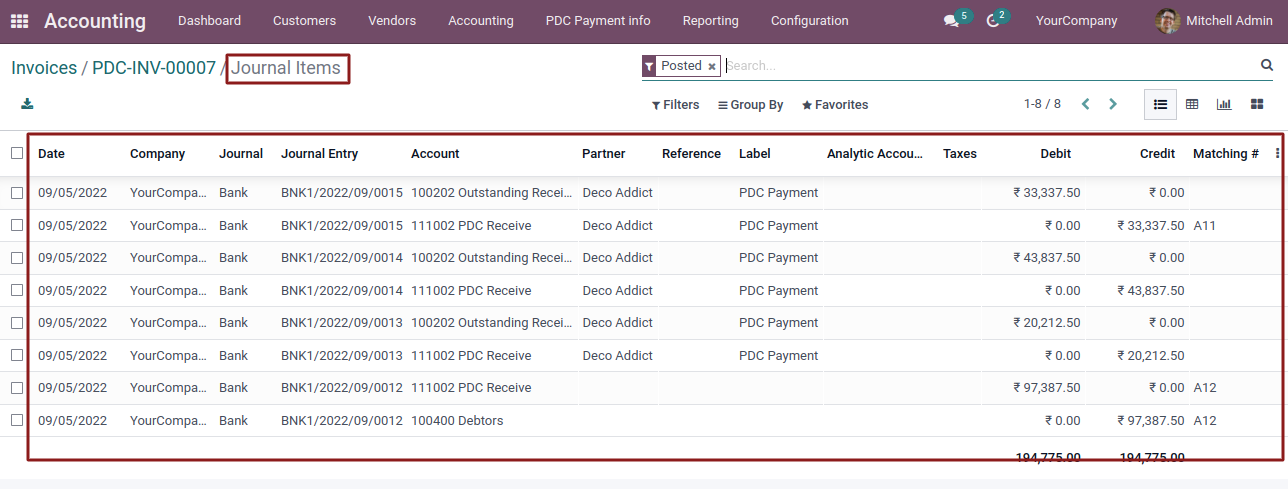

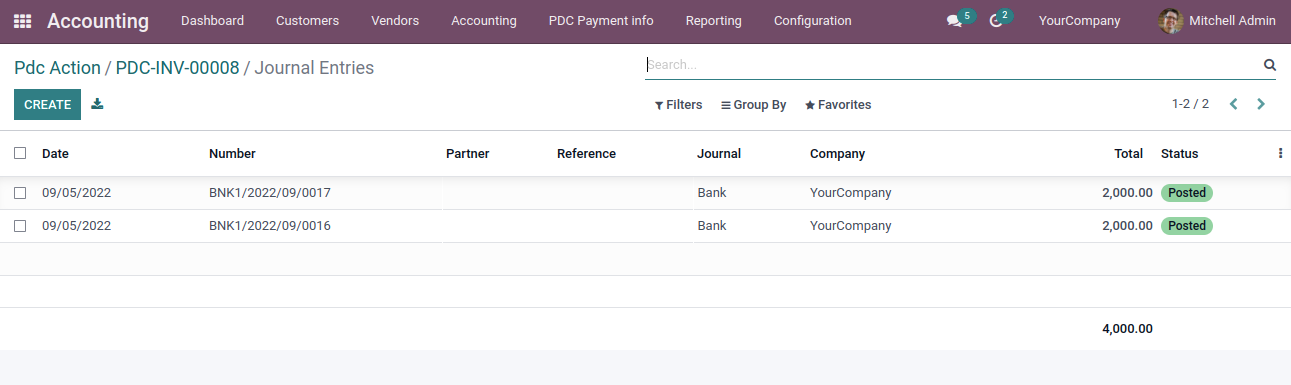

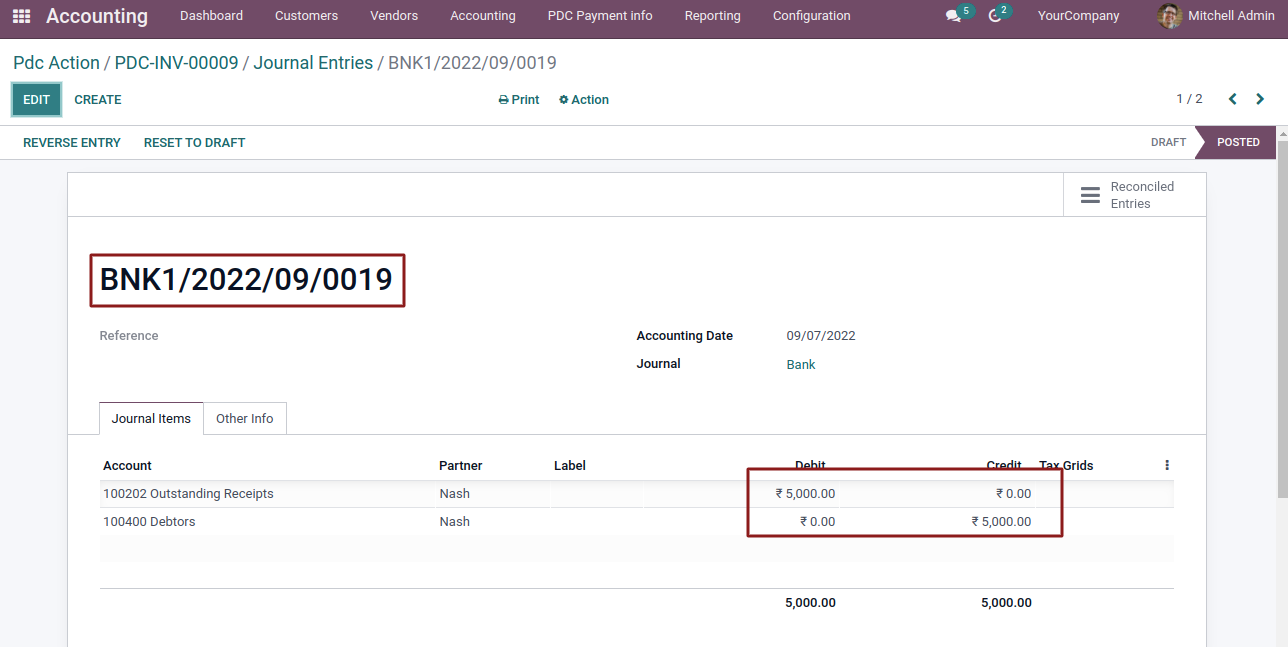

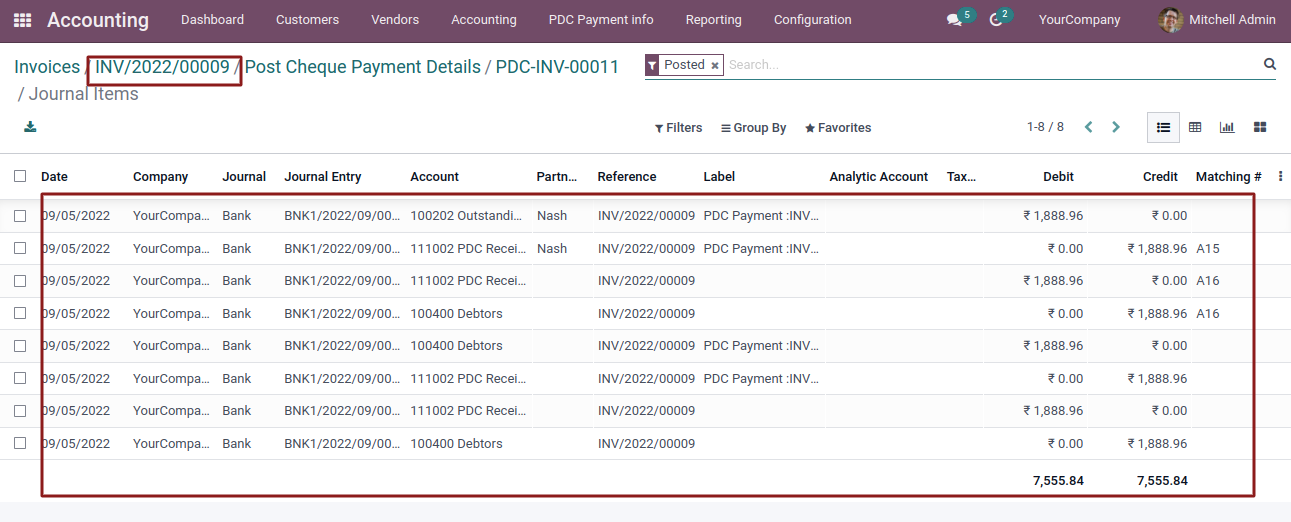

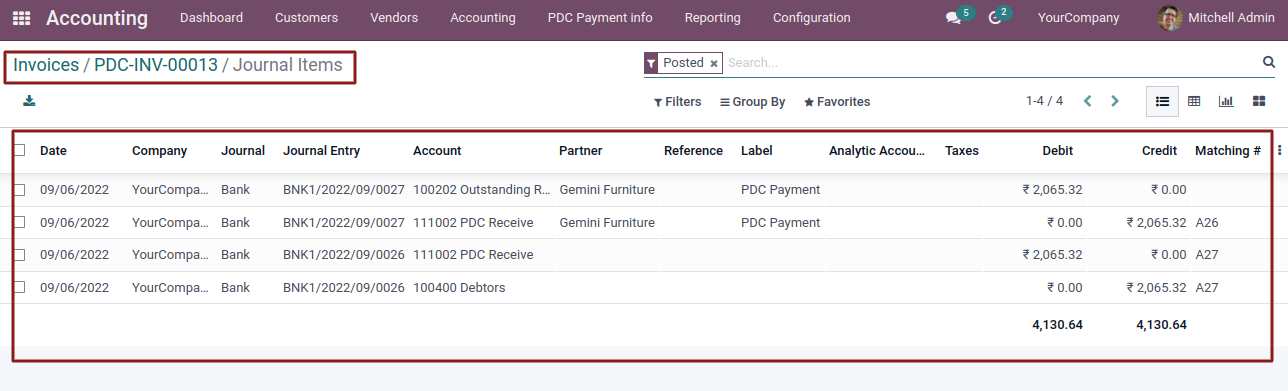

- journal entry and journal items are created

-

We pay payment amount in 3 diffrent ways.

1.Less than Payment Amount.

When we accept less than payment amount invoices/bills get "Partially Paid".

2.Equal to Payment Amount.

When we accept equal to payment amount invoices/bills, it get fully "Paid".

3. More than Payment Amount.

When we accept more than payment amount invoices/bills payment status for that are fully "Paid" and balance amount displayed on next invoices/bills of same Customer.

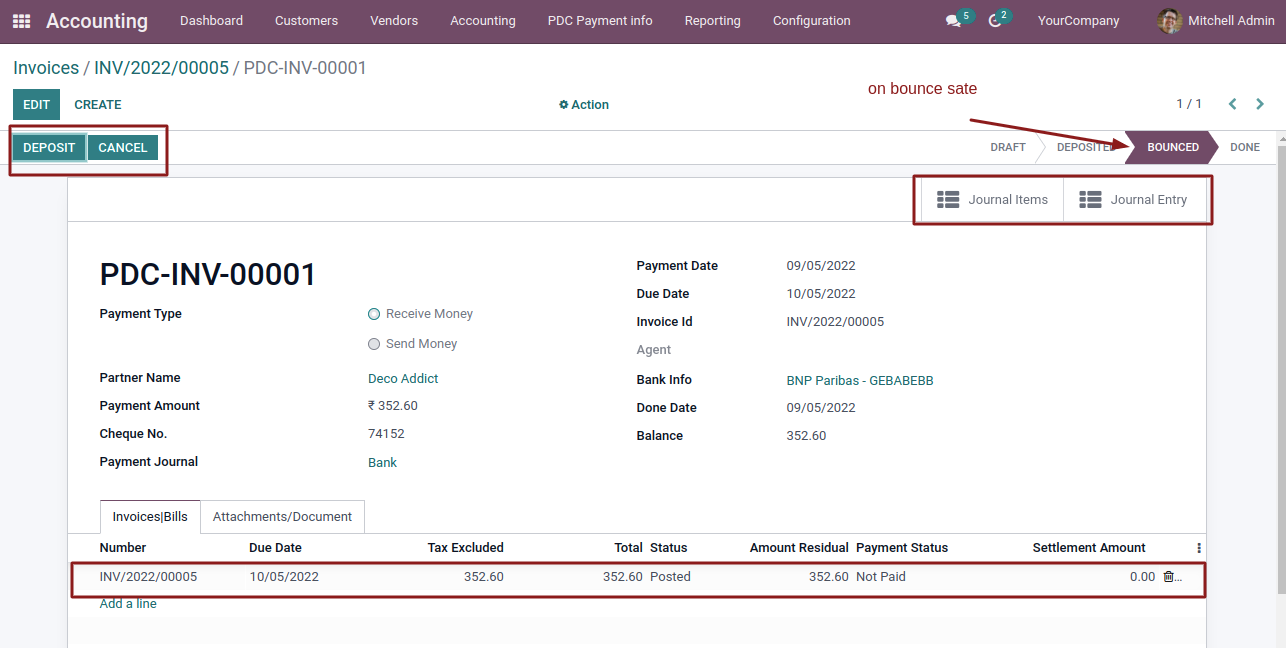

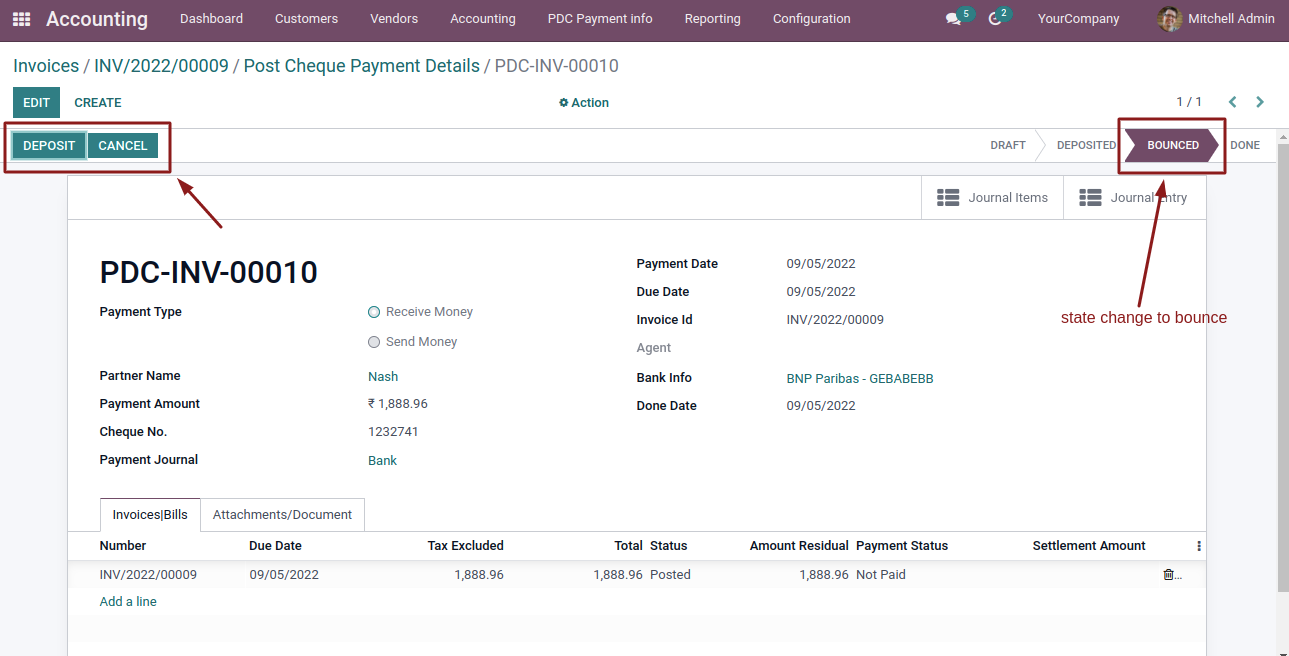

- if cheque get bounced then state change to bounced

- In same way we pay vendor bills.

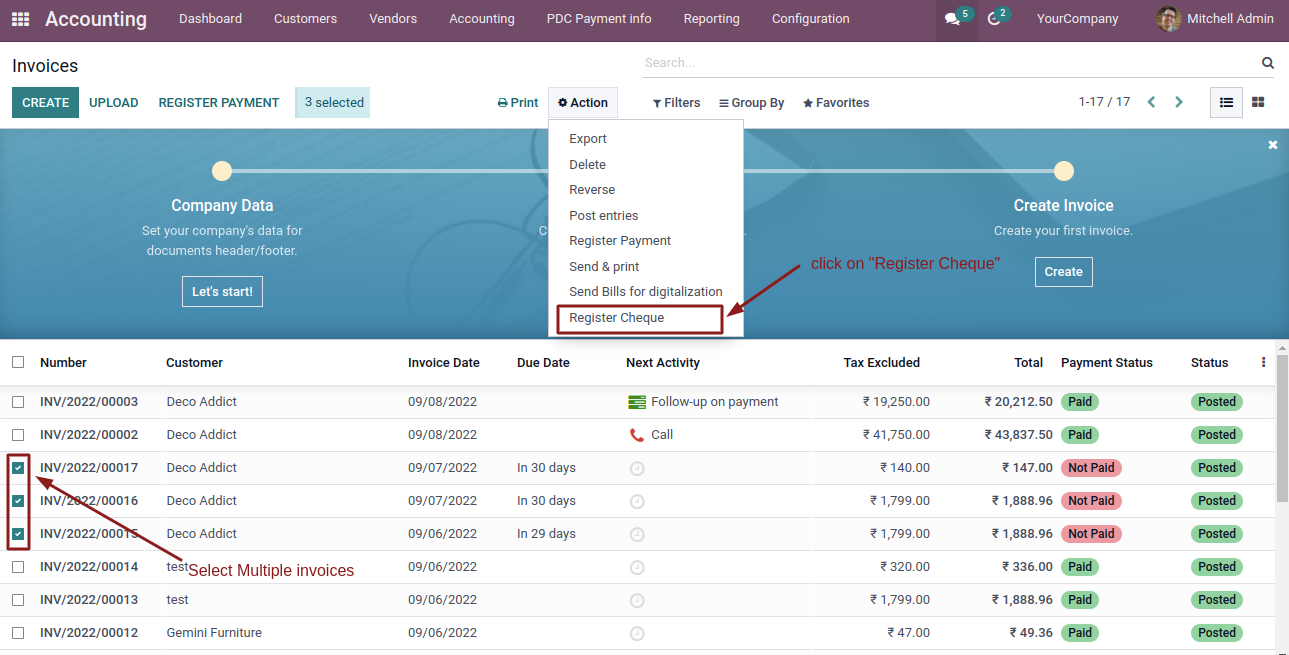

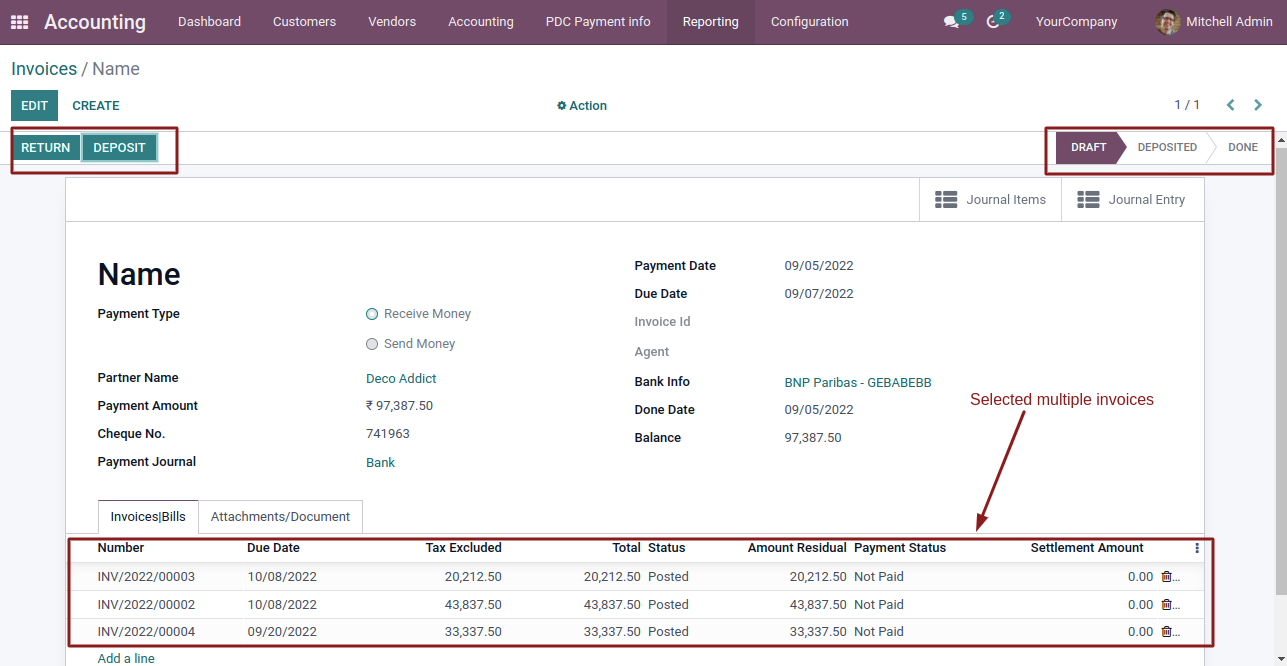

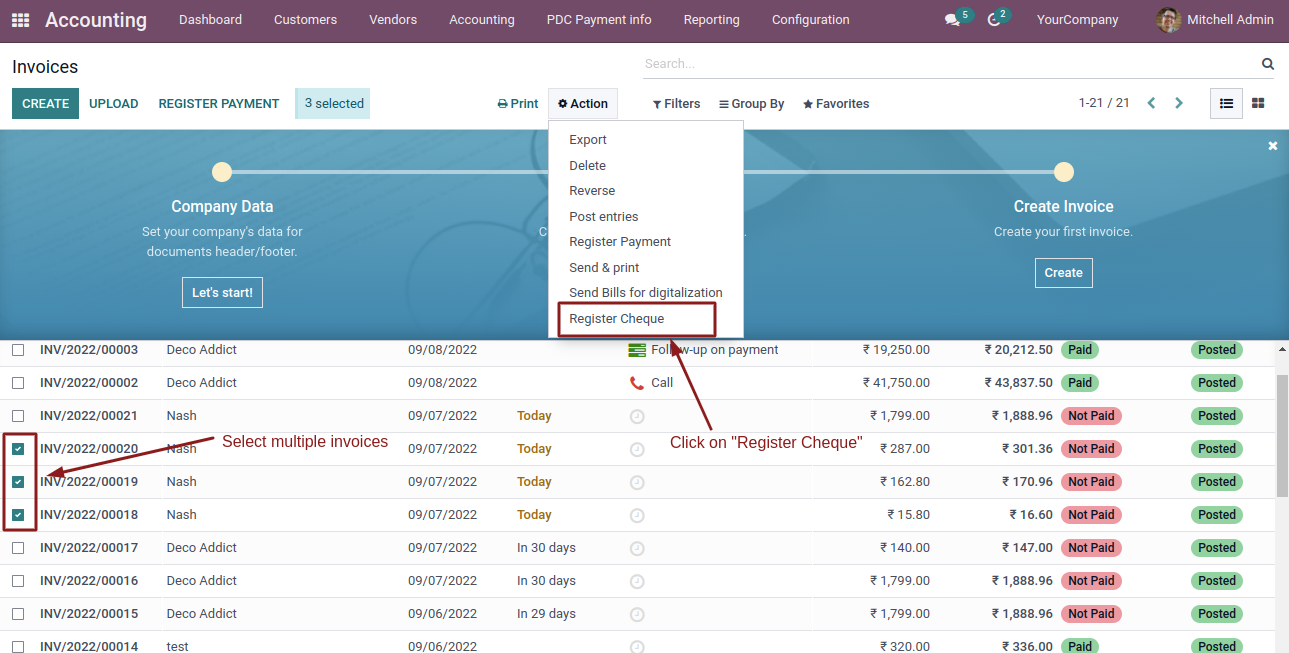

- Select Multiple invoices and Click on "Register Cheque".

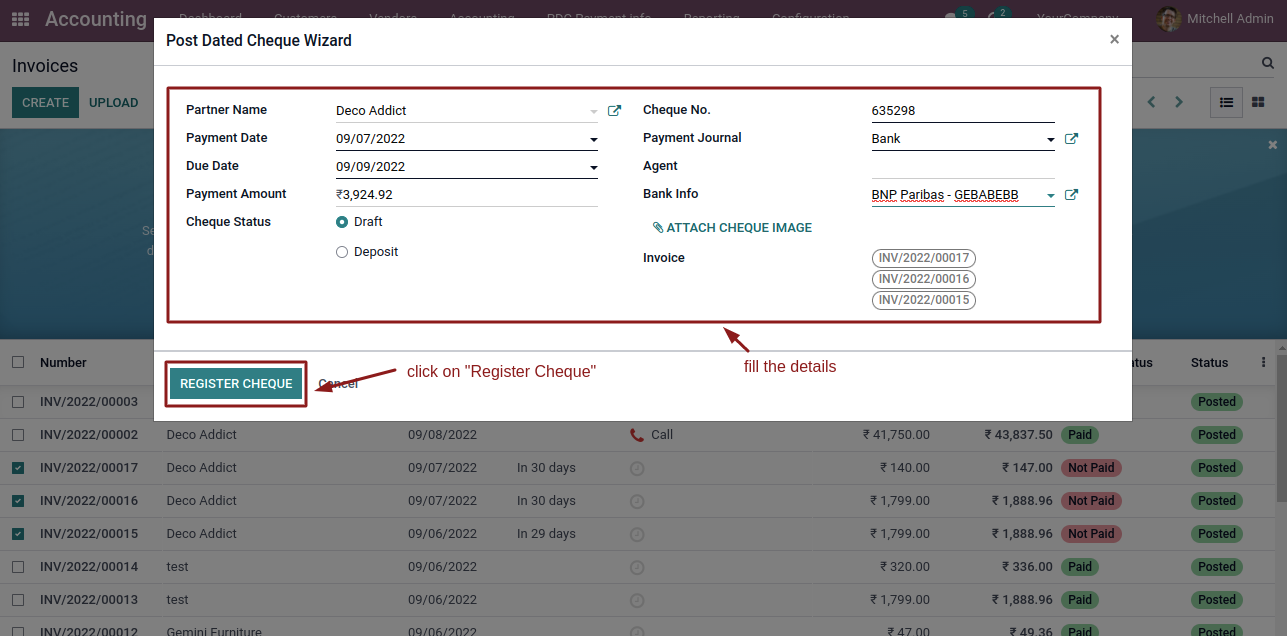

- Enter details.

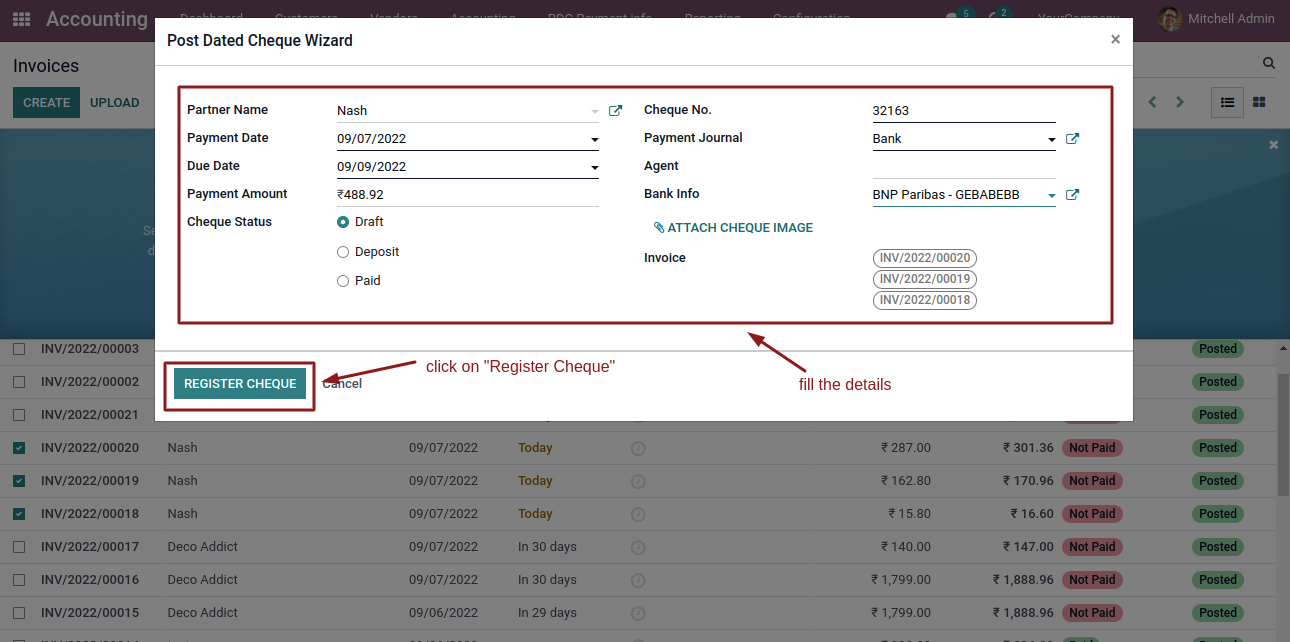

- On entering details and click on Register Cheque button,PDC payment form open.

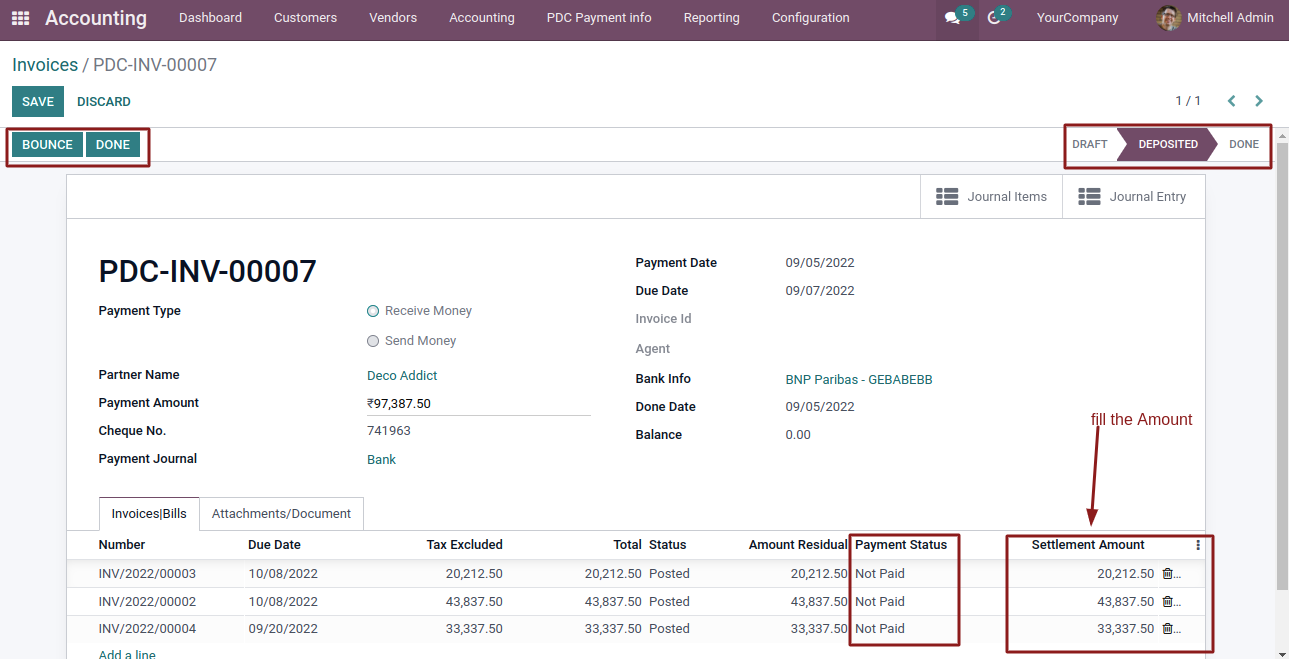

- Fill Amount Settlement in each invoice.

- Click on Done.

- Journal Entery and Journal items are created.

- Tracking of Payment

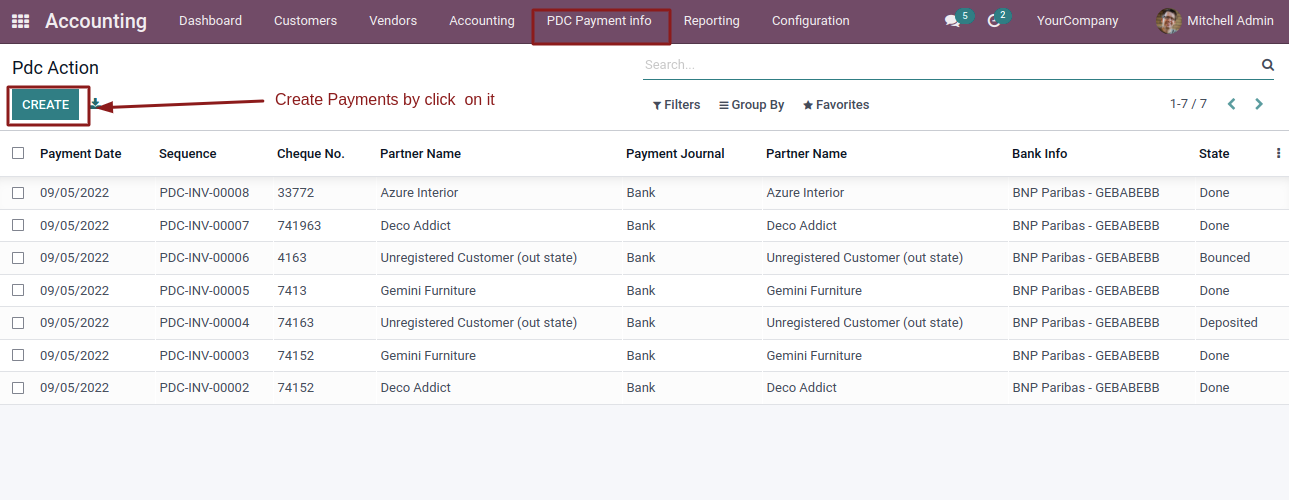

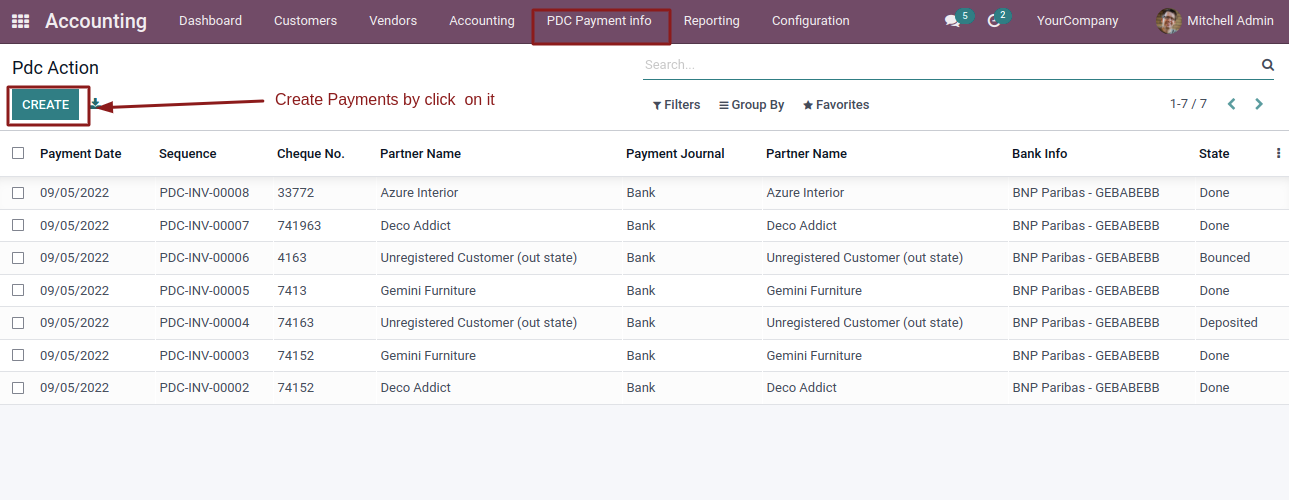

- Click on PDC payment info and makes PDC payments

- Select the partner and payment type and select invoices.

- Click on deposite and done and invoices get paid.

- journal enteries are created.

- We can accept advance cheque payment by select partner and amount

- Entery for advance amount.

- Advance cheque amount displayed on next invoice.

- Same process we perform for vendor Bills.

- Create Invoice and view Register Cheque button(In Posted state) in invoice form

- Enter the cheque details

- On click Return button in PDC payment form,Cheque state Change to 'Returned' state

- On Click Deposite button in PDC payment form State change to Deposited

- Enter the amount settlement and Click Done button

- journal entry and journal items are created

-

We pay cheque amount in 2 diffrent ways.

1.Less than Payment Amount.

2.Equal to Payment Amount.

- if cheque get bounced then state change to bounced

- In same way we pay vendor bills.

- Select Multiple invoices

- Fill details.

- On entering details and click on Register cheque button,then click on deposite button.

- Done State

- Journal entery and journal items created.

- Click on PDC payment info and makes PDC payments

- Select the partner and payment type and select Bills.

- Click on deposite

- click on Done.

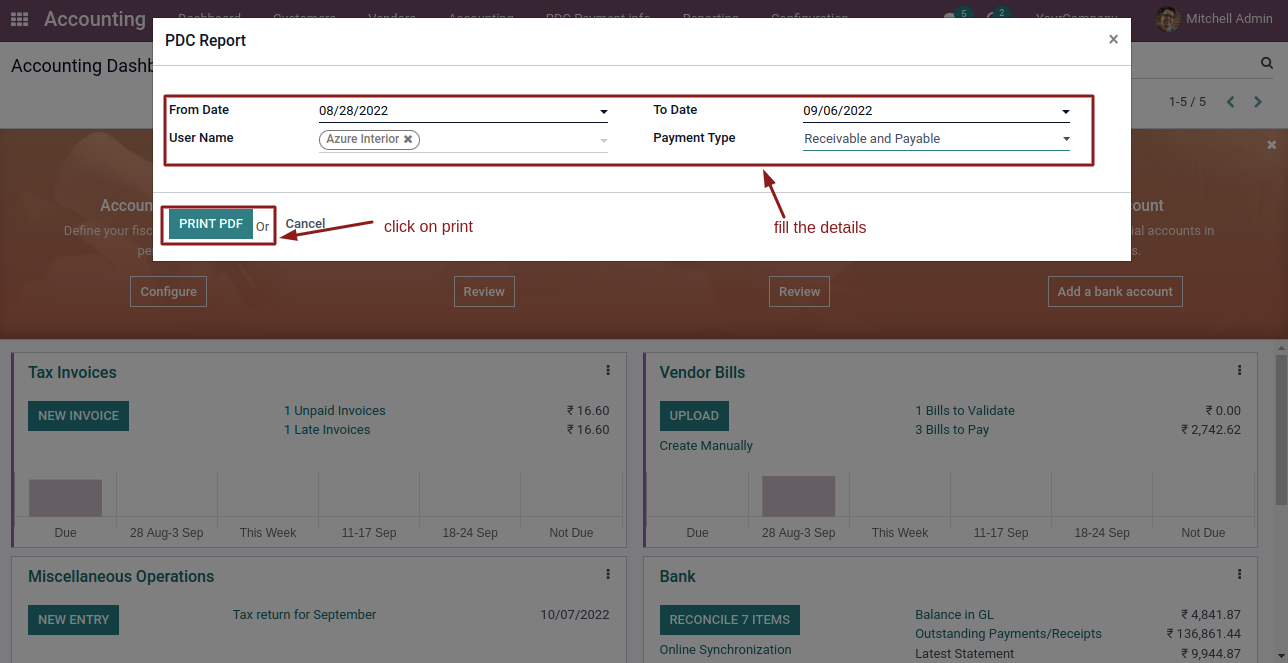

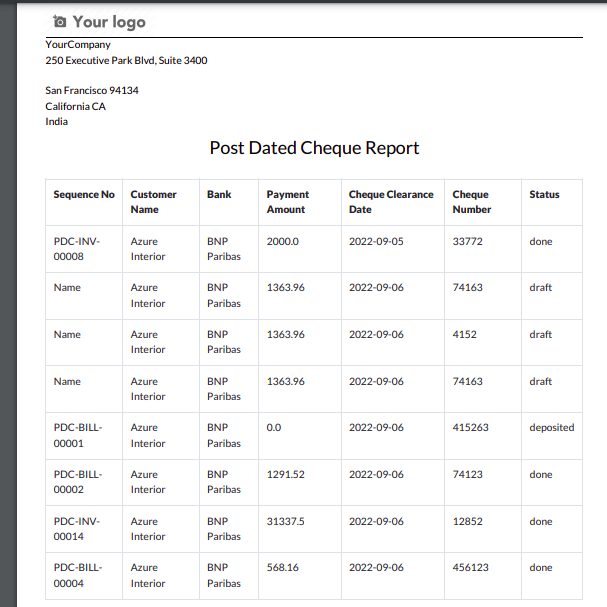

- In Reporting click on PDC Report

- Enter the Details.

-

Website Helpdesk Support Ticket

-

Optimized code.

OPL-1

Comment on this module. Please Login